Employer

Assisting employers in recruiting, training and retaining apprentices and trainees.

Find out moreView Employer Incentives

VisitApprentice / Trainee

Supporting apprentices and trainees throughout the entire process of their training.

Find out moreJob Opportunities

VisitApprenticeships and traineeships are great tools to provide entry pathways to jobs, upskill workers and build local skills in your business.

How we can help

Apprenticeships and traineeships are great tools to provide entry pathways to jobs, upskill workers and build local skills in your business.

Our team of experts will provide all the support and advice you need - free of charge.

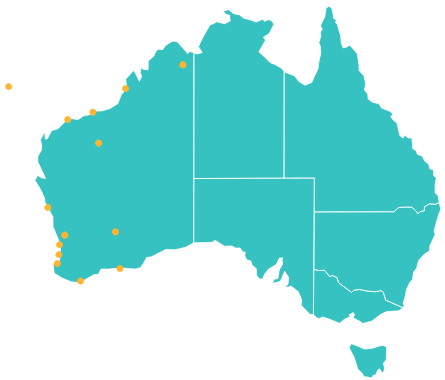

Local experts who are part of your community

We have WA’s largest team of field consultants based in 15 locations across the State:

- Perth

- Northam

- Mandurah

- Bunbury

- Busselton

- Albany

- Kalgoorlie

- Esperance

- Geraldton

- Newman

- Karratha

- Port Hedland

- Christmas Island

- Broome

- Kununurra

Apprentice / Trainee

Current job opportunities: 32

Check out our jobs board nowSubmit an application for upcoming positions

We support employers and apprentices across all industry sectors.

Register nowSubscribe to Training Insider

Receive regular updates about the latest apprenticeship and traineeship news and practical advice from our experts.

Register now