While wages picked up over the March quarter, unemployment lifted over April, according to data released this week. CCIWA Senior Economist Sam Collins explains.

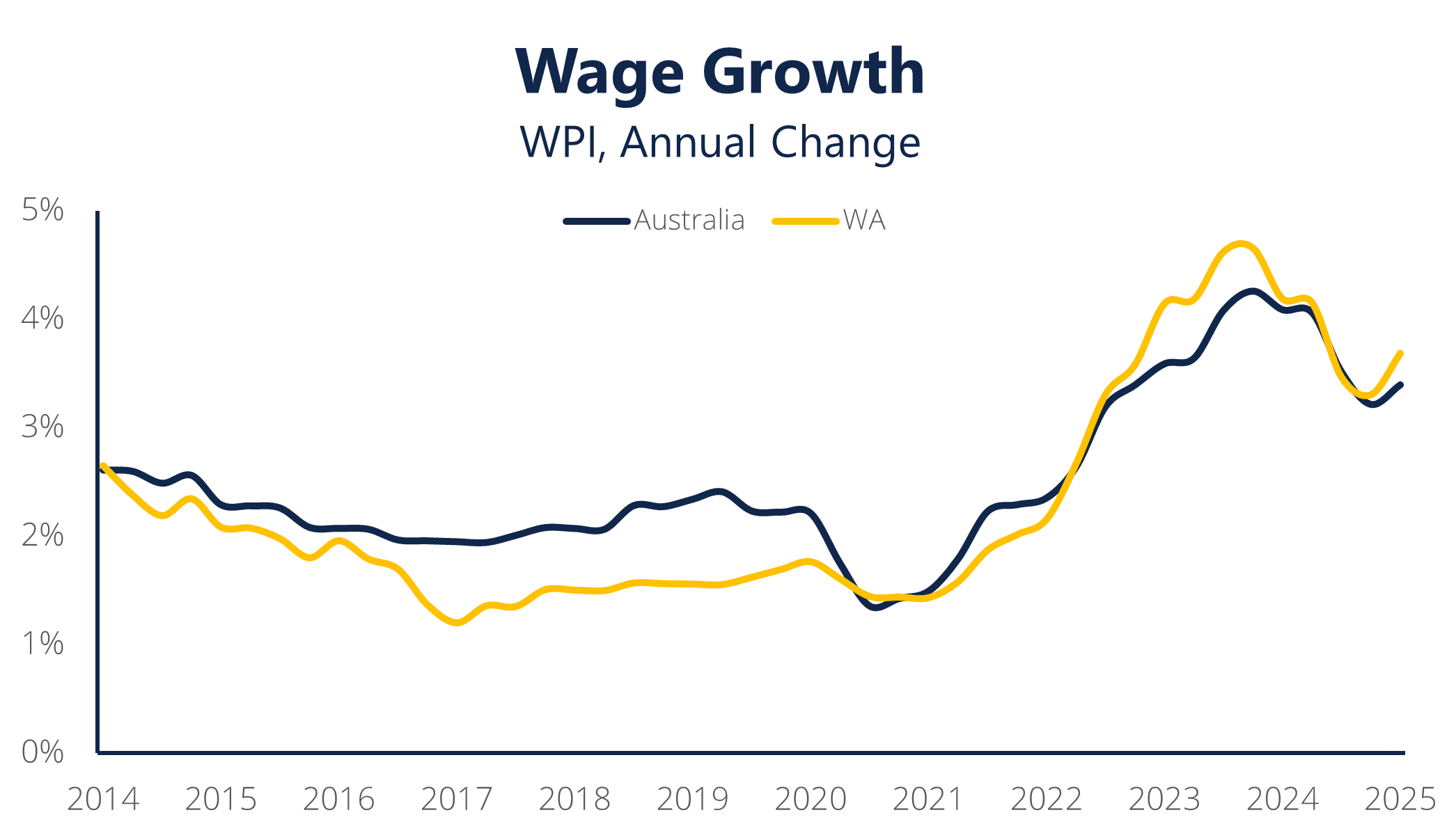

Wages growth picks up for first time in over a year

Source: Australian Bureau of Statistics (ABS)

WA’s Wage Price Index (WPI) rose 1.0% over the March quarter, taking wage growth over the year to 3.7%. This is up from the 3.3% recorded in December and has seen WA return to having the fastest pace of wage growth of all states.

Public sector wage growth was the key driver behind the acceleration in growth, growing 4.5% over the year to March – up from 2.1% in December. In contrast, private sector wage growth fell marginally, from 3.4% in December to 3.3% in March.

On a national level, wages rose 0.8% over the quarter to bring the annual pace of growth to 3.4%, up from the 3.2% recorded in December. This was slightly stronger than expected, with healthcare enterprise bargaining agreements the key driver behind this.

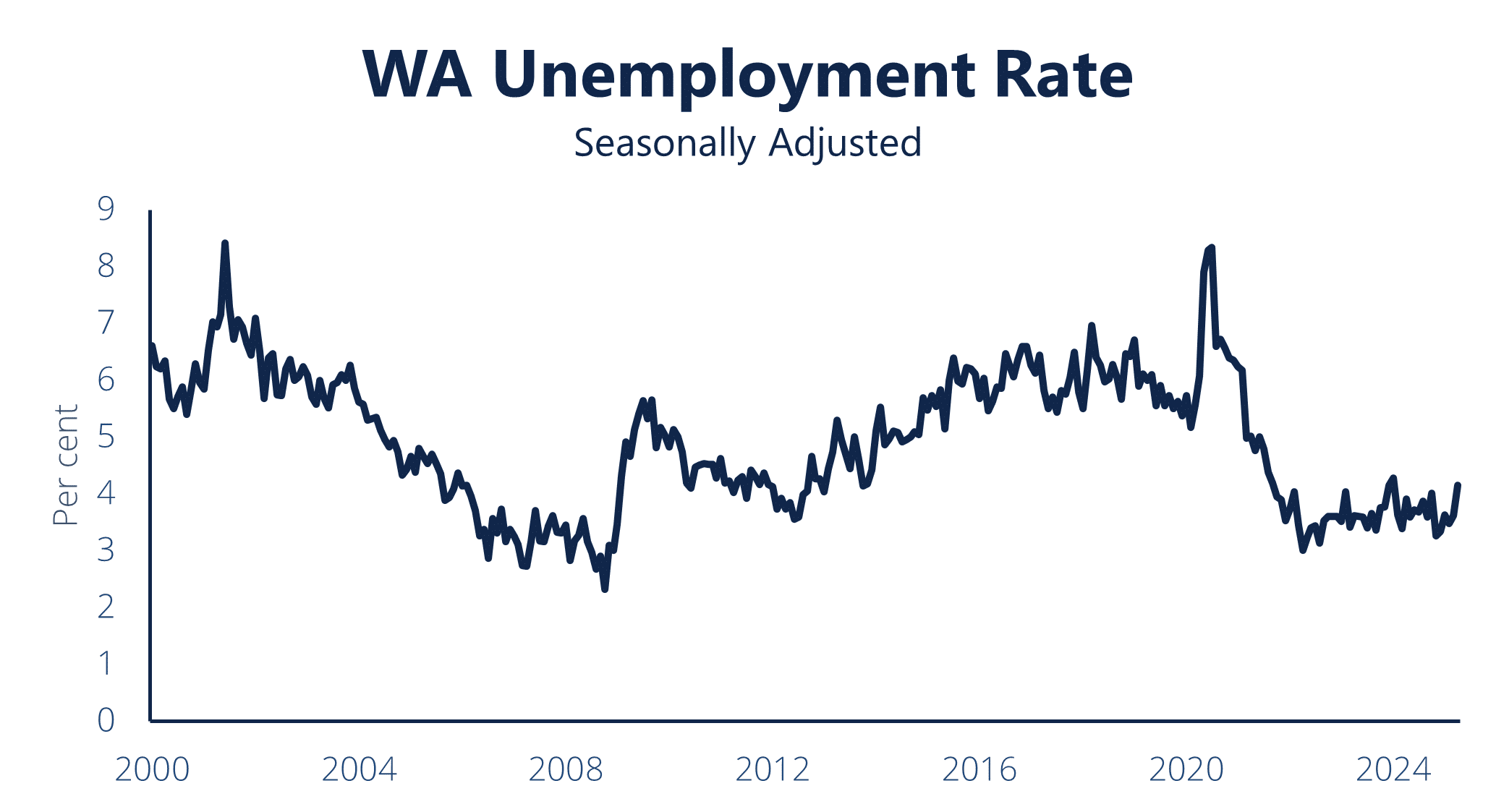

WA’s unemployment rate lifts to highest in 16 months

Source: ABS

Labour force data released this week revealed WA’s unemployment surged over April, rising 0.5 percentage points to 4.2% – the highest reading since January 2024. Despite the increase, this remains well below the 10-year average of 5.2%, indicating the labour market continues to be relatively tight.

The number of people in employment fell for the second straight month, with 2,800 fewer people working in April than in March. At the same time, the number of unemployed people rose by 9,200 to reach its greatest level since July 2021. The underutilisation rate – the broadest measure of workforce capacity – remained steady at 9.4%, as the number of people underemployed fell over the month.

Nationally, the unemployment rate remained unchanged over the month at 4.1%, with an additional 89,000 people entering employment – as has often been the case recently, this increase was above market expectations.

What this means for WA businesses

WPI and labour force data were the last key releases before the RBA’s highly anticipated meeting next week. The strength of these two data points has pared back expectations of some who were expecting a mega 50-basis point rate cut. CCIWA maintains its view of a 25-basis point cut to be delivered on Tuesday, which should provide some much needed, albeit marginal, relief to the WA businesses impacted by interest rates.

CCIWA’s Economic reports are available exclusively to CCIWA Complete, Advantage and Corporate Members. For more, see CCIWA’s Economic Insight page.