As JobKeeper 1.0 ends, there are more than just financial considerations to make – you also need to prepare for changes to special workplace flexibilities, regardless of whether you qualify for 2.0.

Moving to JobKeeper 2.0

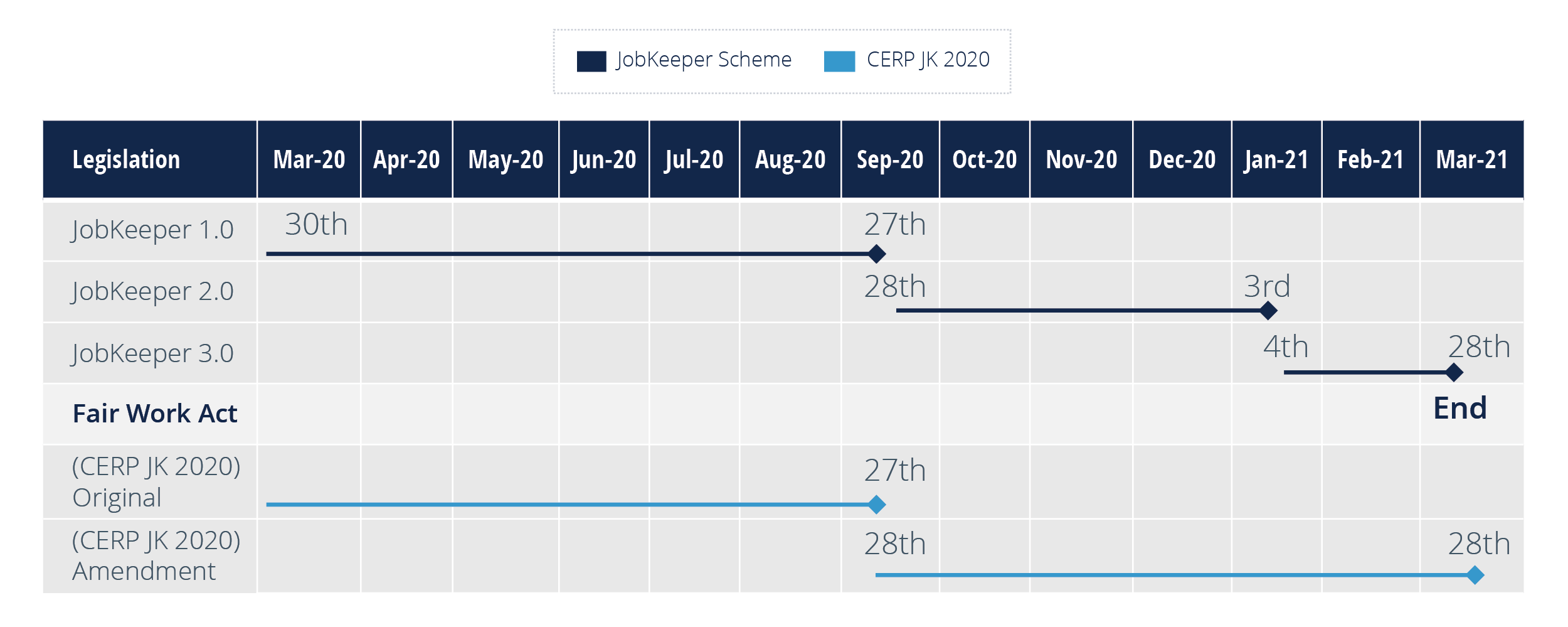

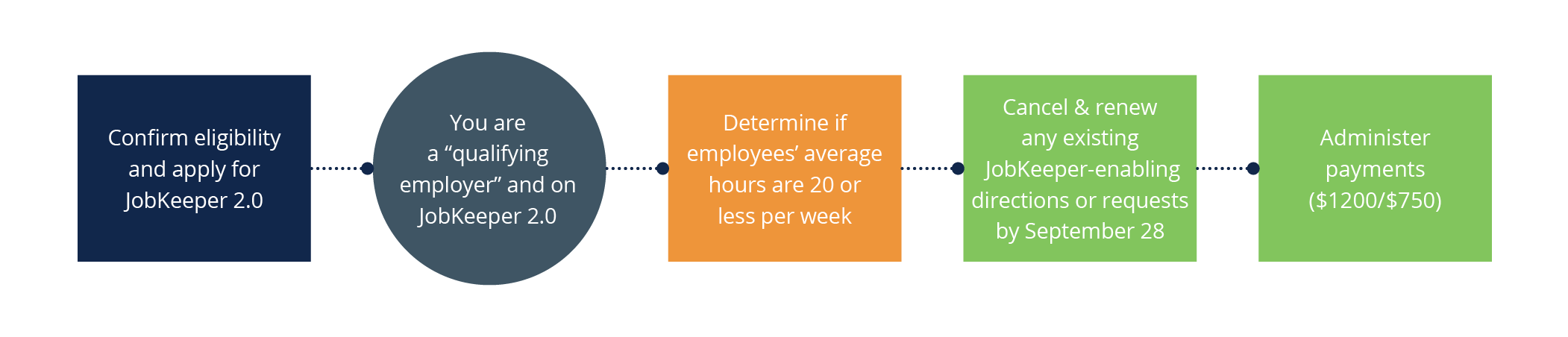

You will need to apply for JobKeeper 2.0, even if you meet the eligibility requirements and have been on JobKeeper 1.0 – you don’t automatically transfer to the new iteration. The same holds for JobKeeper 3.0.

You will also need to cancel and then renew any JobKeeper-enabling directions or requests by September 28.

One of the fundamental differences between JobKeeper 1.0 and 2.0 is the two tiers of payment for employees. The first JobKeeper payment was $1500 per fortnight to all eligible staff.

In JobKeeper 2.0, staff averaging more than 20 hours per week are entitled to a $1200 a fortnight JobKeeper subsidy, and those who average 20 hours or less earn a $750 a fortnight subsidy.

JobKeeper 3.0 will see payments decrease further.

You will need to determine which tier your employee fits into and administer the payments accordingly. To do so, you must consider the average hours an employee has worked during the pay periods over the four weeks immediately before July 1 or March 1, 2020, whichever is greater.

JobKeeper was recently amended to include employees working from July 1, 2020. This means more of your employees may be eligible. You must ensure all employees eligible for the subsidy are receiving JobKeeper payments.

It’s also important you get a sense of whether or not you can sustainably support your current workforce into the longer term. Redundancy entitlements continue to accrue while an employee is being supported by JobKeeper.

Ending JobKeeper

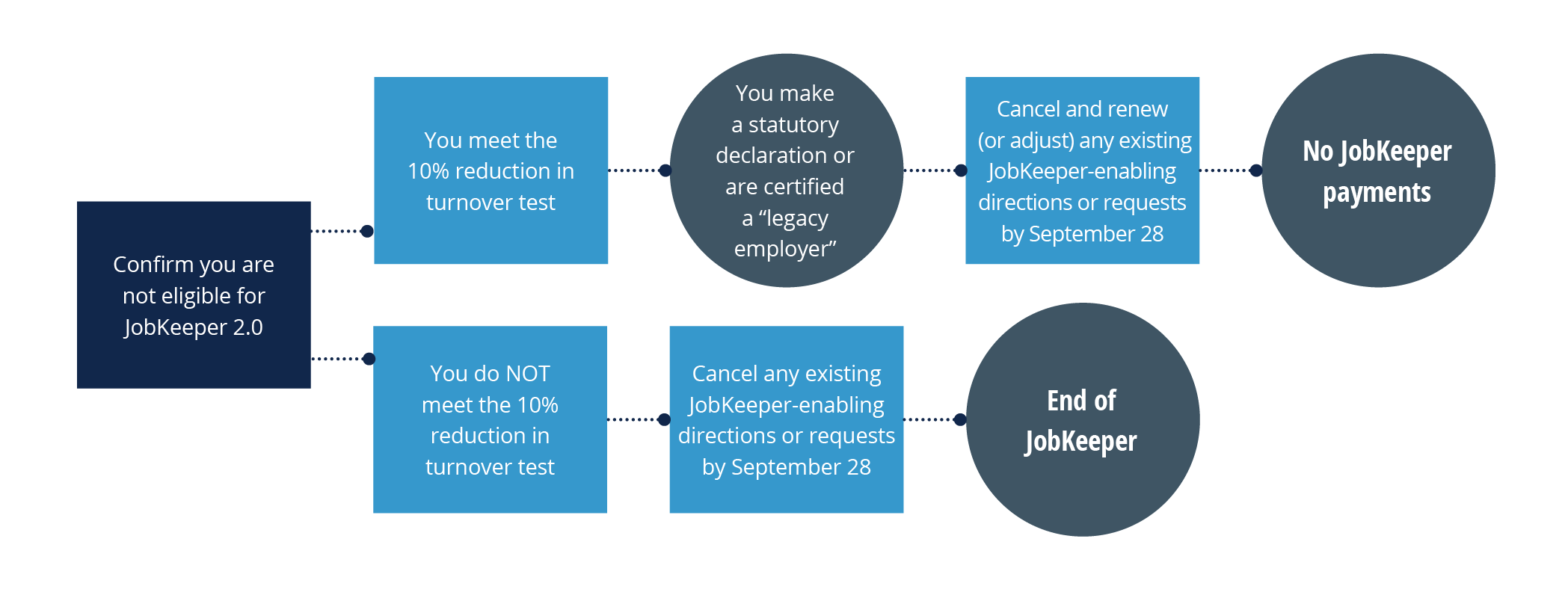

If you aren’t eligible for JobKeeper 2.0, you will still need to cancel any existing JobKeeper-enabling directions or requests and notify staff.

You may still be eligible for certain flexibilities if you qualify as a ‘legacy employer’. A legacy employer must be able to demonstrate a reduction in turnover equal to, or greater than, 10 per cent of the turnover they made at the same time last year.

Becoming a legacy employer

Legacy employers can retain limited flexibilities under the JobKeeper-enabling directions and requests that were there before, however, these must be re-issued from September 28, 2020.

A legacy employer must have previously received an iteration of JobKeeper, but is no longer eligible (or forgoes) JobKeeper the next.

They must also be able to demonstrate a decline in turnover of at least 10 per cent or more for the relevant quarter, compared to the same time last year.

The business will need a certificate from an eligible financial services provider to qualify. Small businesses may be able to make a statutory declaration instead.

Any documentation made for this purpose must be kept for your records.

Legacy employer flexibilities

Legacy employers can direct staff to perform alternative duties, and vary the location of work, as long as these directions are reasonable.

They can also request that employees work on alternative days or times, and employees cannot unreasonably refuse this request.

Employers must consider an employee’s personal circumstances when making this request, as well as the impact on the business and other workers.

Legacy employees can also issue stand-down directions, but can no longer reduce an employee’s hours by more than 60 per cent of that employee’s contracted ordinary hours, and for no less than two consecutive hours in a day.

A legacy employer must give seven days’ notice to issue such a request or direction, while under JobKeeper, employers only need to give three days’ notice.

Getting it right

Whether you’re navigating JobKeeper 2.0 or the new legacy employer provisions, there are several new rules around how you can issue directions and requests, notification times and consultation requirements.

Businesses face fines of more than $66,600 if they do not issue directions or requests correctly, while individuals face fines of up to $13,320 for not getting it right.

We highly recommend calling the Employee Relations Advice Centre on (08) 9365 7660 or emailing [email protected] for additional guidance on this complex matter.

This article has been developed from CCIWA's HR Quarterly Briefing - Emerging from the Wreckage, which took place on September 17, 2020. For more, along with updates on recent, significant case law, watch the presentation by CCIWA Employee Relations Advisor Chris Nunn. Enter password: awicc1709