Current economic conditions in WA make it an ideal time to sell your business – if you are ready.

But preparing for a sale or succession can be challenging for many reasons, with emotion, stress, decision fatigue and complexity all in play.

CCIWA Member PricewaterhouseCoopers (PwC) explains your options when preparing to exit your business.

Why sell?

WA has experienced faster growth than other States as it recovers from COVID-19, with an expected 3.5 per cent lift in Gross State Product during 2021-22.

An increase in business investment played a significant part in this growth, with a 10.8 per cent lift in business investment from December 2020 to March 2021.

As PwC Co-Head of Corporate Advisory Chris Bingemann says, buyers are looking for opportunities to invest in businesses.

“We are in a very active market at the moment – there is a lot of money out there, and everyone is looking at multiple opportunities,” he says.

But, he adds, this also creates complexities.

“There are a lot of competing opportunities and buyers only have a certain amount of resources and time and therefore their interest can be short before moving to the next opportunity," he says.

"The deal that is well presented, clean (and) simple is the deal buyers are seeking to minimize the opportunity cost."

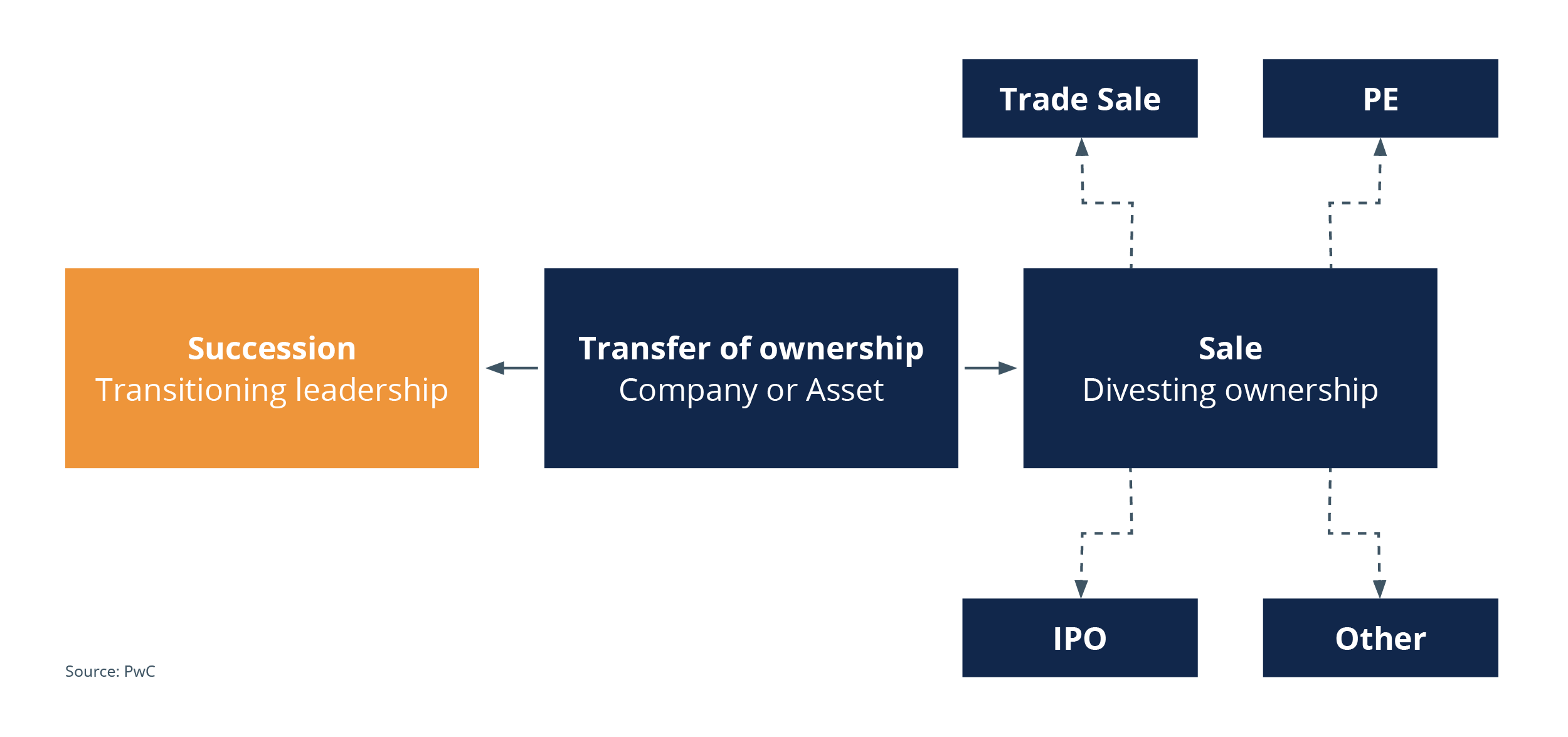

Succession vs sale

A succession event and a sale both involve a transition of ownership and an eventual change in leadership.

As PwC Director of Private Clients Lee Nugawela explains, a family business that is well set up for succession will also be well positioned to sell.

“Fundamentally, everything is similar – how you prepare for a succession event is very similar to how you would prepare for a sale,” he says.

“The key thing is planning.”

Preparing your business for succession/sale

PwC outlines six key areas to focus on for family businesses.

“The entire family may or may not be working in the business but the key is understanding each and every person in the family’s core objectives and what they want,” he says.

“Communication within the family isn’t done that well.”

He adds that 70 per cent of wealth transitions fail and the overwhelming reason is trust and communication within the family.

“What are we doing to protect the family's wealth, when can they actually take (a business) on in some way, shape or form – will it be the physical business or the passive wealth generated from that business?” he asks.

“What flows from there is education … it’s understanding the fundamentals.”

“It’s a big gap we found, particularly over the last 10 years that family members don’t really understand what wealth means to them,” he says.

Organisations including PwC run education workshops to help families better understand wealth matters.

“You have probably spent a lot of your life generating this business venture, and you have got to give it away in one event, so you want to plan for it,” he says.

“It takes many years to plan for an upcoming event and make sure you’ve got your structures and everything that supports it in the right space.”

Nugawela says tackling these issues should be done early in the piece when discussing succession or sale plans.

This comes back to the communication protocols within a family unit.

As a business owner, you should ask yourself:

- How will I deal with someone knocking on my door and asking to buy my business?

- What processes do I have in place?

- How do I deal with conflict?

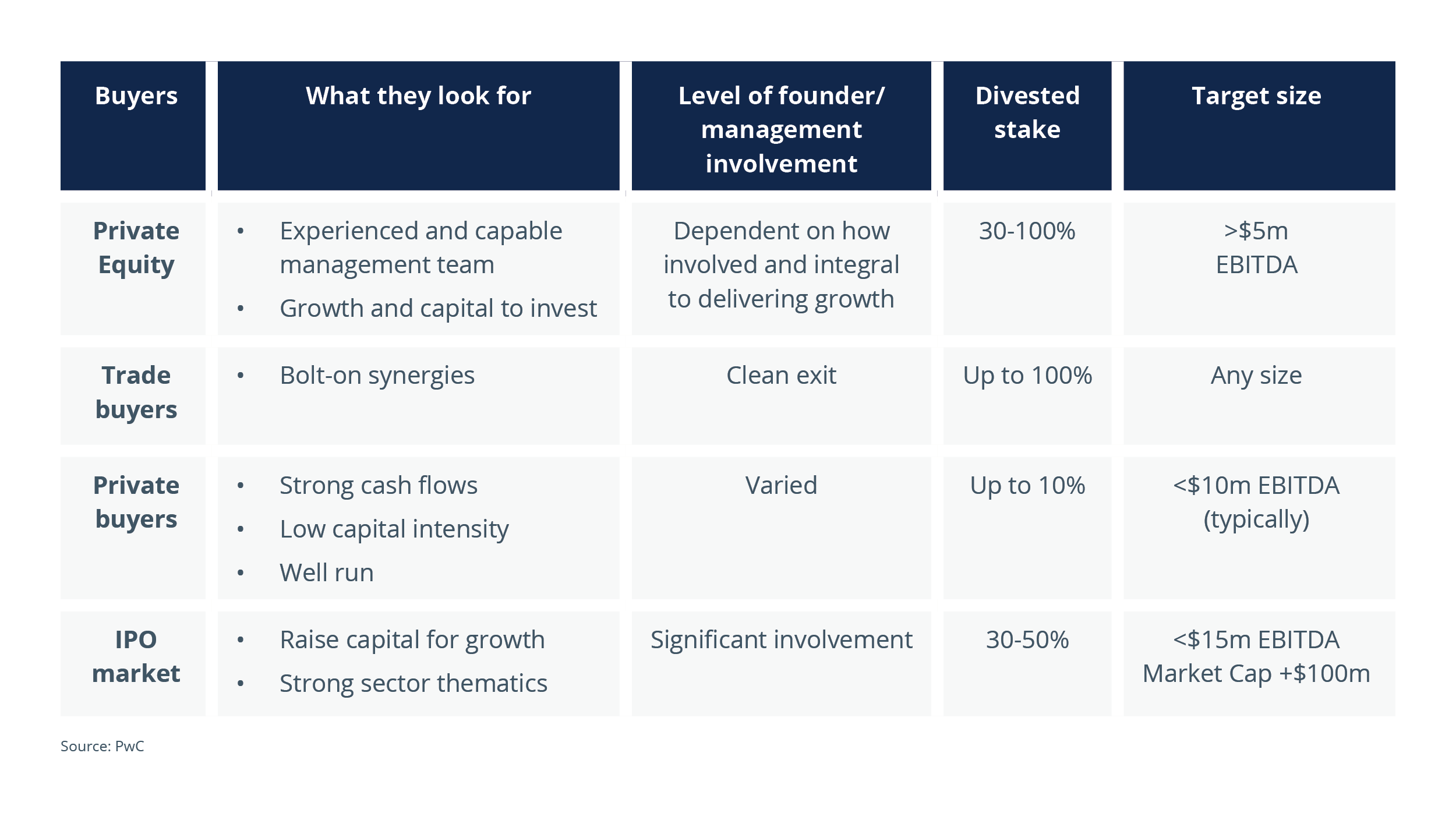

Buyer types – what are your options?

The way you structure your business before sale has a significant impact on the type of buyers it will attract, as Bingemann explains.

He breaks down buyer types into four main categories:

Trade buyers will look to incorporate your business into their own and are likely to know your business operations well. On most occasions, they want to take control as soon as they buy the business, but there may be a transition period.

Bingemann says trade buyers usually present a “clean exit” for business owners.

“PE invest in management teams and businesses,” Bingemann says.

“PE groups typically invest in you and your management team, because that's what's going to drive the business going forward. They're not experts at running your business - your management team is and you are.”

As an owner, selling to a PE buyer may not enable you to extract yourself totally from the business if there is not a ready-made management team in place.

Private buyers are usually looking to invest in stable businesses with less than $10 million earnings, Bingemann says.

Bingemann says a lot of businesses get approached by brokers encouraging them to list their company.

“You have got to make sure you are the right business for it," he says.

Being fixated on share price, publicised company announcements, and being locked into a structure are all part of taking your business down the IPO path.

Selling through the IPO market means you may need to maintain a strong involvement in running the business and maintain a significant interest to show commitment.

What next?

Understanding your role post-sale is a crucial part of the process.

As Nugawela explains, you may want to step away from the business completely or still maintain a stake.

“You are going to want to do something next, once you have gone through a sale transaction,” he says.

“We’re seeing a lot of families start a new business venture, but there could be some sort of philanthropic interest, which is a massive interest at the moment."

He says understanding what that does and how you can achieve that is important.

Then it's about making sure your structures reflect that, he adds.

CCIWA is here to help your business.

To get in touch, contact our Employee Relations Advice Centre on (08) 9365 7660 or [email protected].