The latest building activity data shows Western Australia’s housing supply continuing to struggle to meet surging demand, with total dwelling completions declining 8.1% over the June quarter.

This is despite the number of new commencements rising a modest 1.6% over the same period, while the number of approvals also continues to swell.

As a result, the residential construction pipeline continues to remain backlogged, with nearly 27,000 dwellings waiting to be finished – over 5,000 more than the decade average.

This continues to place pressure on the State’s construction industry, which is still grappling with labour shortages in key trades and the high cost of materials. Given this, we expect new dwelling supply to remain constrained in the short term but to improve gradually over the coming years.

German manufacturers continue to contract, dragging on activity

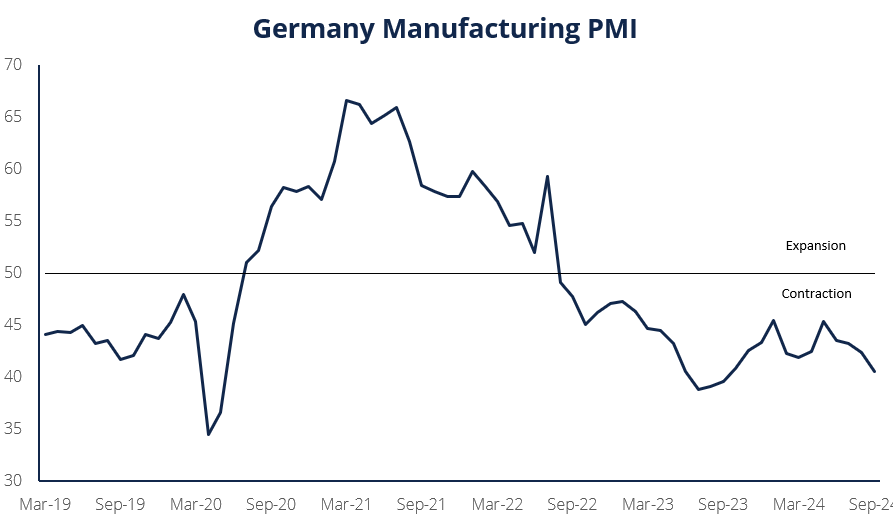

Germany’s manufacturing purchasing managers index (PMI) fell to 40.6 in September, sharply below expectations and now the weakest reading in a year.

With a PMI below 50 indicating a contraction in the manufacturing sector, this result underscored the steepening of contractionary momentum in the sector over the last 12 months.

Businesses reported market uncertainty, hesitance to invest and overall weakness in the key auto manufacturing sector. Given the significance of the sector to the Eurozone’s economy, this poor performance has been a driving force behind region’s weak level of output.

US labour market stronger than expected

The US unemployment rate has ticked down again in September to 4.1%, marking the second consecutive monthly decrease and beating expectations of no change.

This was largely driven by a 281,000-person fall in the number of unemployed as the participation rate remained steady. At the same time, 254,000 jobs were added, which is the strongest jobs growth in six months.

This stronger than expected result has given some weight to the US Federal Reserve slowing the pace of interest rate cuts following its 50-basis point cut in September. Fed Chair Jerome Powell has since said “this is not a committee that feels like it is in a hurry to cut rates quickly”.

CCIWA’s Economic reports are available exclusively to CCIWA Complete, Advantage and Corporate Members. For more see CCIWA’s Economic Insight page.