What we’re standing for

We have a track record of championing policy, based on the principles of free enterprise. By standing together, we amplify the voice of our stakeholders – businesses, families, consumers and the WA workforce – to make WA the best place to live and do business.

We capture and define our policy and advocacy under five pillars:

Keep costs low; Regulation that helps not hinders; Ensuring a Skilled Workforce; Supporting Emerging Industries; Positioning WA

Telling the story of WA’s economy

We provide timely, accurate and insightful analysis of the WA economy. By leveraging conventional, alternative and real-time data sources, we comprehensively unpack key issues facing the global, national and state economies and form a robust view about WA’s economic future.

As well as providing regular insights and commentary on the economy through the media, we also publish four key economic reports:

A quarterly survey that is the longest running and most comprehensive of its kind in WA. We publish our expert analysis of t he short- and longer-term economic outlook and businesses’ expectations about issues such as capital expenditure and skills availability.

A quarterly survey that provides insights into the attitudes and sentiments of WA consumers. The report contains analysis about short- and longer-term expectations of economic conditions and the major concerns for WA households in the year ahead.

A quarterly report that provides regional breakdowns of key results from the CCIWA Business Confidence Survey.

Outlook is CCIWA’s biannual analysis of the WA economy and contains forecasts on key economic indicators, including Gross State Product, household consumption and unemployment.

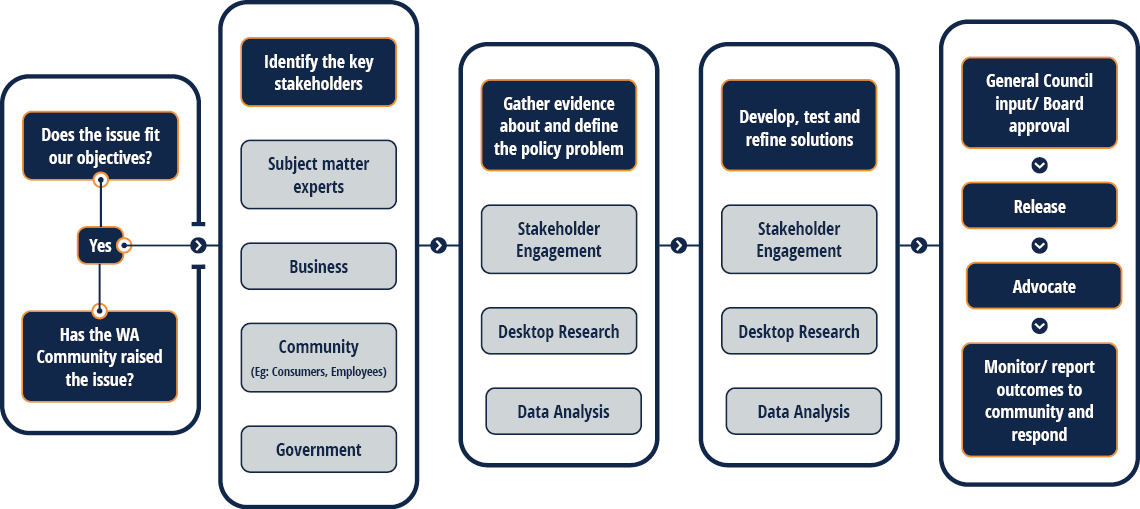

Our policy process

We develop & advocate for good public policy.

the best place to live and

do business.

We decide which policy issues to tackle based on their alignment with this objective. We only take on policy issues that are of practical relevance to the WA community.

Here is how we do it.

To make sure we’re developing policy positions that ensure WA is the best place to live and do business, we listen to and work with stakeholders across the community to understand their challenges.

We engage with businesses of all sizes and across all industries to hear their concerns and identify ways to address them. We work with regional chambers, indigenous bodies and many other WA and national industry associations.

We regularly meet with government agencies and decision-makers to understand their perspectives. And we talk to WA individuals and families to find out how different policies and working arrangements affect them.

We engage with our stakeholders in a range of different ways to make sure we’re enabling them to share their diverse perspectives. We connect using digital tools, such as surveys and webinars, as well as face to face through meetings, roundtables and workshops.

We are committed to developing principled, robust and practical policy solutions that improve the wellbeing of the WA community.

We research broadly and consider different viewpoints. And we back our positions with rigorous analysis of the economic and policy landscape, leveraging conventional, alternative and real-time data sources.

Our positions on different policy issues are transparent and public. We communicate our positions in plain English. And we advocate using traditional, digital media, as well as by putting forward our views via submissions and at events and other public forums.

If we are not achieving our policy objectives, we reflect, learn and change our approach.

Policy Submissions and Letters