A rebound in automotive fuel prices (+7.2%) is also supporting higher inflation, as oil prices picked up over the past three months following production cuts from the Organization of the Petroleum Exporting Countries (OPEC) and the outbreak of war in the Middle East.

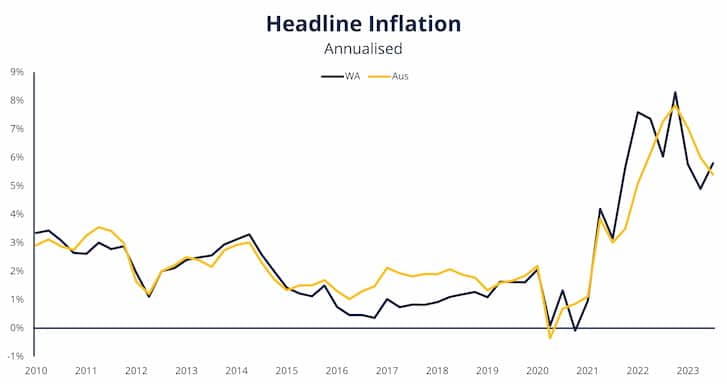

In Perth, the inflation rate increased to 5.8% for the year to September, up from 4.9% in June. However, this figure is distorted by the electricity subsidies provided by the State Government this time last year – Perth recorded the smallest quarterly increase in prices out of all capital cities, with prices rising only 0.4% since June.

While inflation has continued its downward trajectory, it is not falling as fast as economists had expected or the RBA would like. Given this, along with some of the rhetoric coming from RBA Governor Michele Bullock over the past month, CCIWA is anticipating another increase in the cash rate when the RBA meets next week.

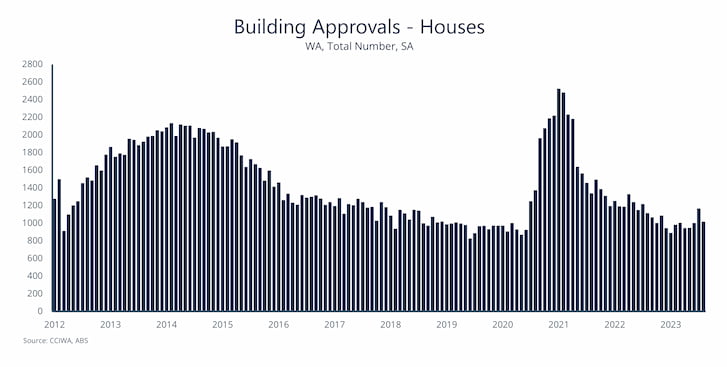

Soft housing approvals weigh on future supply

CCIWA’s Economic reports are available exclusively to CCIWA Complete, Advantage and Corporate Members. For more see CCIWA’s Economic Insight page.