Perth’s inflation rate has eased slightly over the June quarter to sit at its lowest level in four years, according to data released today. CCIWA Senior Economist Sam Collins explains.

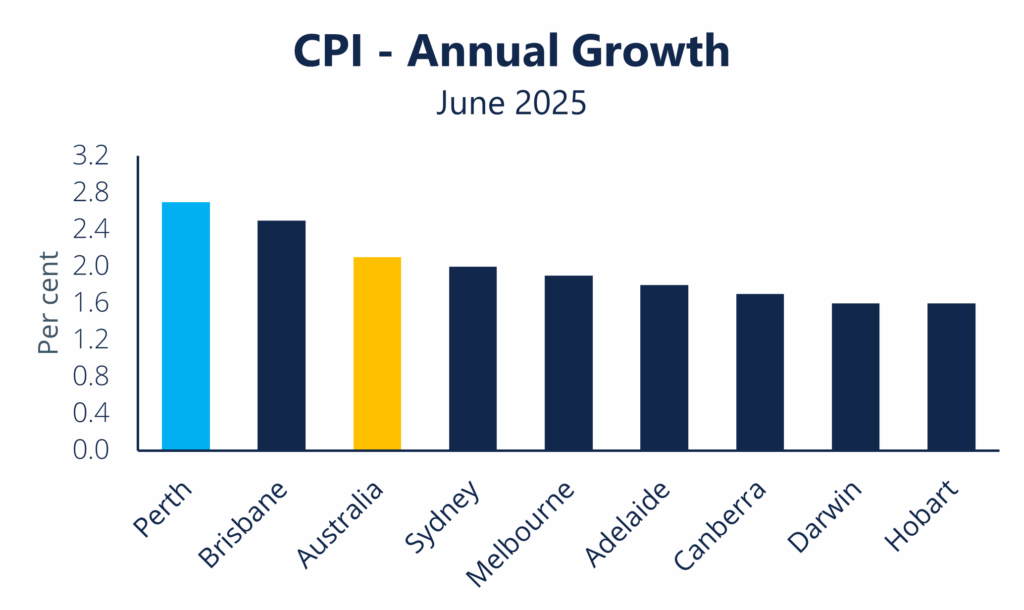

The latest Consumer Price Index data released this morning showed prices in Perth rose 1.9% over the June 2025 quarter. This takes the annual rate of headline inflation to 2.7%, down slightly from the 2.9% recorded in March 2025 to sit at its lowest in four years. Despite the fall, Perth has again recorded the highest annual rate of inflation across all capital cities.

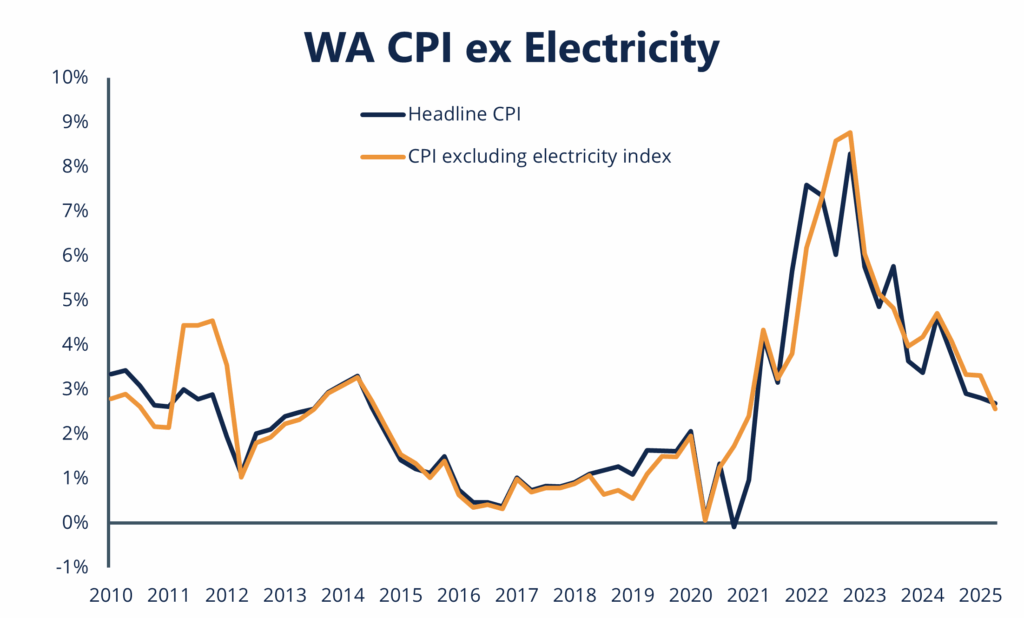

Excluding the electricity index, given the impact from electricity subsidies provided by both the State and Federal Governments, Perth’s annual rate of inflation was 2.6% – down significantly from the 3.3% recorded in March.

Some of the main contributors to the increase this quarter were electricity (+116.8% QoQ) following the end of the household electricity subsidies, international holiday travel and accommodation (+4.7%) heading into the winter holiday travel period, and medical and hospital services (+2.5%). On the flipside, Perth drivers benefited from the easing of automotive fuel (-3.3% QoQ) as international demand for oil declined, while insurance prices were also lower (-1.7%).

Nationally, prices rose 0.7% over the quarter and 2.1% over the year. Importantly, trimmed mean inflation (which is the RBA’s preferred inflation measure) fell to 2.7%, creeping closer to the midpoint of the RBA’s 2-3% target band.

What this means for WA businesses

The decline in inflation at the national level was largely in line with the RBA’s forecasts, with trimmed mean inflation now sitting in the upper half of the target range.

While the RBA will remain cautious, provided there are no major surprises between now and the next meeting on August 11-12 (with tariff announcements from the United States being a key watch point here), this result should cement the widely expected interest rate cut at that meeting.

This should provide some much-needed relief to the many WA businesses needing to make interest repayments or looking to increase borrowings.

CCIWA’s Economic reports are available exclusively to CCIWA Complete, Advantage and Corporate Members. For more, see CCIWA’s Economic Insight page.