Western Australia’s peak industry bodies and business leaders attended a Premier’s roundtable today to discuss the critical need to maintain WA’s share of the GST.

Image: Roger Cook/LinkedIn

The 2018 deal, which secured WA a 75-cent floor in GST revenue and delivered fairness to the GST system for the first time since its introduction in 2000, will be reviewed by the Productivity Commission in 2026.

Prominent business figures – including those from Fortescue, Hancock Iron Ore, Wesfarmers, Satterley, CBH Group, Hesperia and Perdaman – came together with CCIWA, the Chamber of Minerals and Energy WA, Association of Mining and Exploration Companies and the Australian Hotels Association to underline the nationally critical importance of the current GST arrangements.

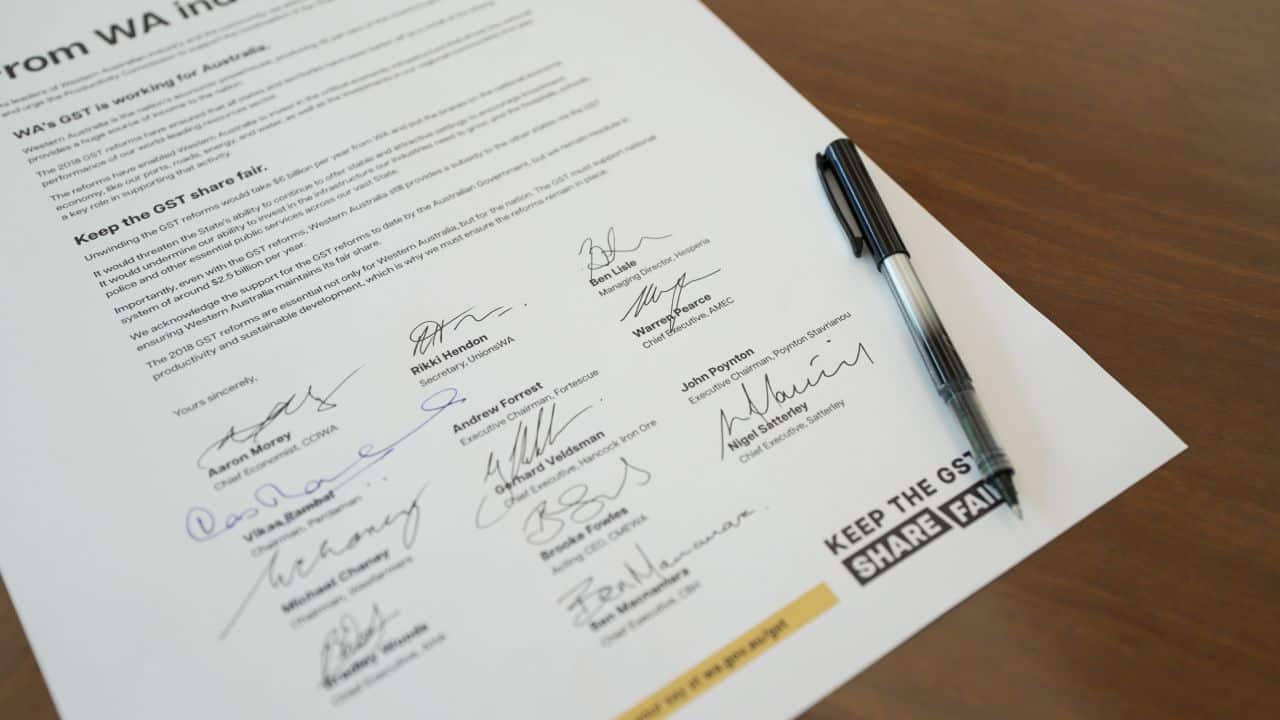

The group collectively signed an open letter calling on the Federal Government and Productivity Commission to maintain the 75-cent GST floor.

The reforms underpin WA’s ability to invest in the economic and social infrastructure that drives national prosperity.

When WA does well, the nation does well

CCIWA Chief Economist Aaron Morey said the group was committed to keeping pressure on the Federal Government to maintain the status quo.

“WA’s strength is the nation’s strength. When WA’s economy does well, it lifts the living standards for all Australians,” he said.

“The additional GST revenue flowing back into WA under the 2018 deal allows our State to invest in the economic infrastructure that supports our national economy.

“This economic infrastructure includes the roads and rail networks that get WA resources to market, the crucial energy and water infrastructure that allows our industries to operate, and the housing, hospitals and schools that support the tens of thousands of workers who drive our industries.

“That’s why it’s vital for all Australians that WA is not left worse off under any change to the GST distribution.”

WA Treasurer Rita Saffioti said the reforms were “in the national interest”.

“While we recognise the support of the Prime Minister to continue the GST reforms, we will not leave anything on the table in our campaign to ensure WA continues to receive its fair share of the GST,” she said.

Next steps in the national debate

Insights from the roundtable will help inform the State Government’s submission to the Productivity Commission’s review of the GST distribution.

CCIWA has convened a steering committee of leading WA business figures to guide its advocacy as the national debate intensifies in 2026.

“We have convened a powerful steering committee, featuring prominent WA business leaders Andrew Forrest, Michael Chaney, John Pynton and Nigel Satterley, to guide CCIWA’s strategic advocacy on the GST,” Morey said.

“Although we’ve been encouraged by the Prime Minister’s commitment to keep WA’s current GST arrangements, we know he will come under significant pressure from East Coast governments to reverse the 2018 deal.

“Now is not the time to be complacent. We have to make it clear to the rest of Australia that WA’s GST allocation supports the economic success of the whole country.”

Visit Keeping WA Strong – our new advocacy initiative to make WA the best place to live and do business. Subscribe to our campaign updates, including on the GST deal, here.