The end of JobKeeper has meant businesses need to closely examine their finances and ask some hard questions about their future survival.

For some businesses, it might be time to examine whether to continue or to prepare an exit strategy.

If you decide to call it quits, it is ideal to get your company in the best shape possible to sell.

Brentnalls WA Director Tony Monisse explains the signs to look out for to determine whether your business is in trouble and suggest some ways forward.

Are you being propped up?

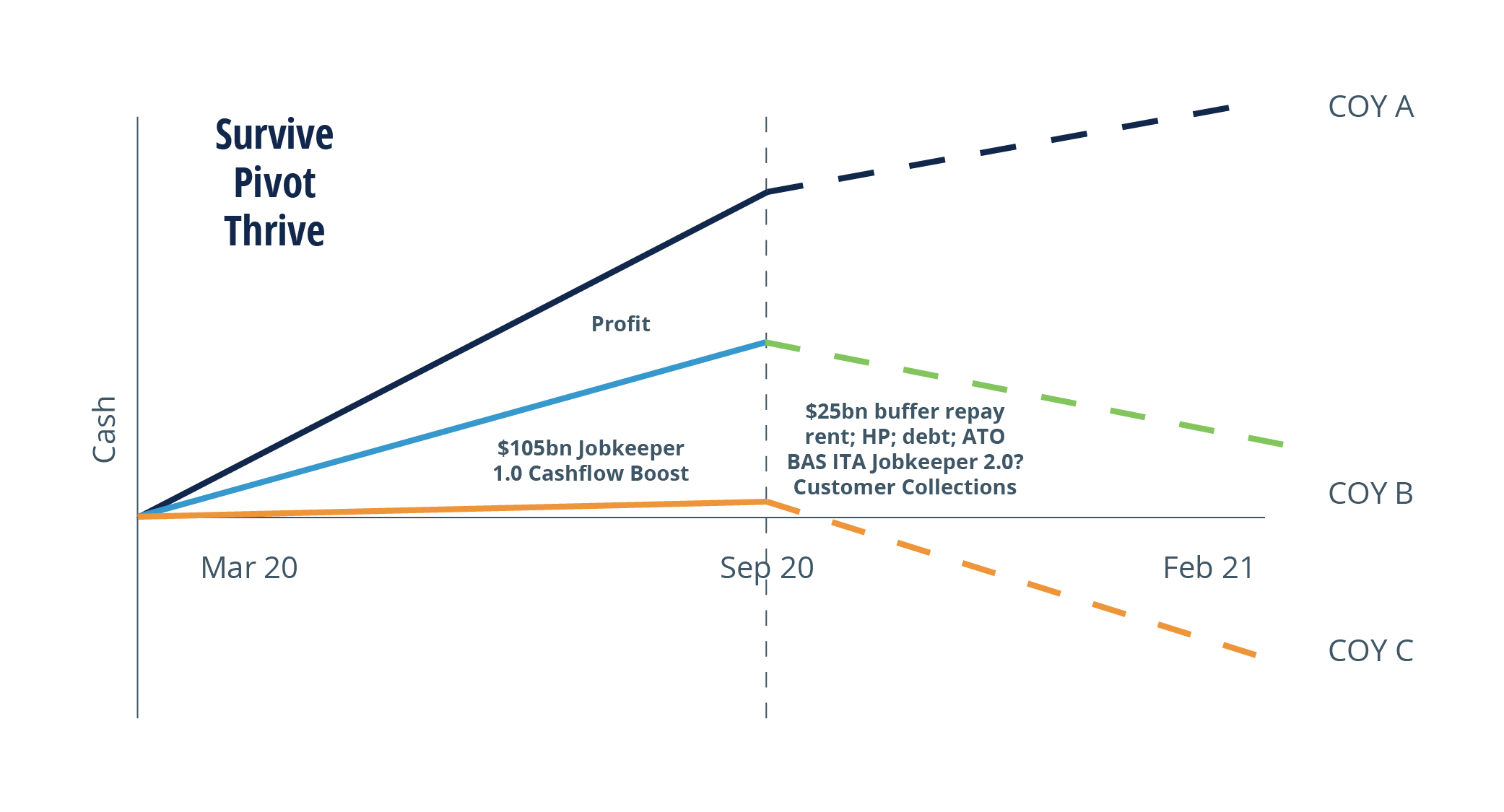

The Federal Government’s JobKeeper scheme has helped many businesses stay afloat during the economic downturn brought about by COVID-19.

But, Monisse suggests, as we start to recover from the crisis it is crucial businesses assess their performance independent of government stimulus.

“A lot of businesses have been supported over this last six months…(but) if you took away JobKeeper those companies would be losing money, even after restructuring their business – the only reason they are in business is because of JobKeeper,” he says.

“It’s really important for a business to look at its trading result before JobKeeper… (but) if once you're coming off JobKeeper you're still losing money, then you've got a real problem.”

Crunch time

According to Monisse, the most important decision to make is whether your business is viable now and into the future.

If the answer is no, then you should ask what you need to do to change that in to keep operating or explore exit strategies.

“A number of businesses aren’t viable once you take away JobKeeper, so it’s a case of looking at it based on future forecasts,” he explains.

“If the business cannot be restructured to be viable, I think it's certainly an avenue that a business needs to look at is whether it should go into administration.”

Indicators of Insolvency

These are the key indicators to keep an eye on when reviewing your business’s solvency:

1. Continuing losses

2. Negative working capital

3. Inability to produce timely and accurate financial information

4. Ongoing negative net assets

5. Unrecoverable loans to related parties

6. Creditors unpaid outside trading terms

7. Solicitors’ letters, demands, summonses, judgements or warrants against the company

8. Suppliers placing the company on cash-on-delivery (COD) terms

9. Dishonoured and post-dated cheques

10. Special arrangements with selected creditors

11. Payments to creditors of rounded sums not reconcilable to specific invoices

12. Inability to obtain finance from bank, related parties or shareholders

13. Overdue taxes

If your business is not viable and solvent now and into the future, then you should ask what you need to do to change that in order to keep operating or explore exit strategies.

“A number of businesses aren’t viable once you take away JobKeeper, so it’s a case of looking at it based on future forecasts,” he explains.

“If the business cannot be restructured to be viable, I think it's certainly an avenue that a business needs to look at is whether it should go into some form of administration.”

Administration does not mean the end

Monisse explains that entering administration can be an effective way for a business to restructure its finances and start afresh.

“There still may be viable businesses that need to go into administration and be restructured, because of what's happened over the last nine months. Since COVID-19 started, a number of businesses have accumulated a significant amount of debt,” he says.

Now they're in a position where they need to repay that debt, but it may not be viable for those businesses to pay that debt within the timeframes required.

“For those businesses where the underlying business is viable but the debt that they have to repay is substantial, going into administration offers a great opportunity for them to restructure those finances.”

It is vital that companies seek advice if they are considering going down the path of entering into administration to explore options and to decide on the best outcome for all stakeholders.