The end of the financial year is an opportune time to review your business affairs as part of your year-end tax planning.

In an exclusive presentation for CCIWA Members, Optima Partners recently explained what you need to know ahead of June 30.

Tax and compliance update

Some of the key tax and compliance updates to look out for include:

- 20% Technology Investment Boost for the 2023 financial year

- 20% Skills and Training Boost for the 2023 financial year

- 20% Proposed Efficient Energy Use Boost for the 2024 financial year

- Temporary Full Expensing has ended on June 30, 2023 but Instant asset write-off still applies to assets under $20,000 for FY24 and FY25

- ATO is extending compliance programs/digital ID systems

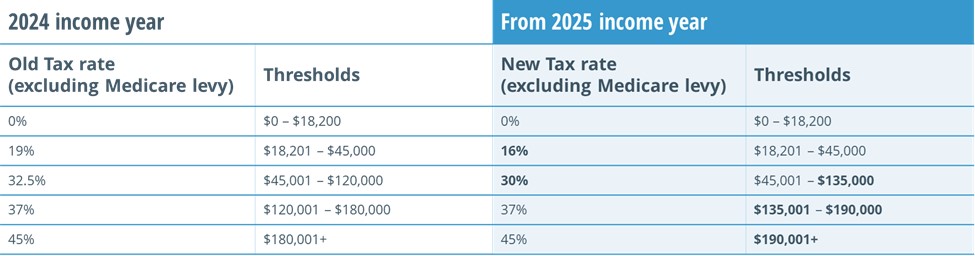

Stage three personal tax cuts

Superannuation guarantee

Superannuation rate changes for compulsory employer super contributions are increasing each year to 12% in FY2025-26.

- 2023 10.5%

- 2024 11%

- 2025 11.5%

- 2026 12%

It is worth noting that superannuation funds and the Australian Taxation Office now have more visibility than ever of a business’ superannuation obligations. The ATO has also signalled that in future obligations will need to be paid in real time (i.e. PAYGW & Super) when wages are paid.

Other Resources

Business reporting obligations

The following are some of the business reporting obligations you need to be aware of when finalising your end-of-year accounts and tax returns.

- Wages reconciliation and STP finalisation

- Superannuation obligation reconciliation – this is not deducible if paid late, and employers must note the change in the SGC rate

- Payroll tax obligations – check you haven’t exceeded thresholds if not registered

- Taxable payment annual reporting (TPAR)

- Building and construction

- Cleaning services

- Road freight and courier services

- IT services

- Security, investigation or surveillance services

- Review accounting data files for potential conversion or rate changes

What to do before year end

- Review year to date figures to determine likely tax liability

- Consider strategies for management of the likely tax position

- Determine dividends to be declared for companies

- Prepare distribution minutes for trusts

- Consider owners remuneration and optimise tax outcome

- Small Business Entities – cash vs. accruals/prepayments/depreciation

- Make superannuation payments as they are only deductible when paid

- Debtor analysis – consider bad debts/timing of invoicing

- Creditor analysis – bring forward expenses to get a tax deduction

- Stock take – undertake a stock take and consider obsolete stock

- Plant and equipment – consider any new equipment needed and ensure its available and ready for use prior to June 30

- Fringe Benefits Tax – if FBT return not lodged consider private portion of expenses and GST adjustments

- Capital Gains Tax – consider the sale of any investments and prepare likely tax calculations

Business structures and tax outcomes

Consider the relevance of the existing structure of your business.

- Section 100a and trust distributions – keep records of payments to beneficiaries to satisfy new ATO rules

- Potential trust distributions to investment companies to retain corporate tax rate

- Division 7a – check owners drawings from companies and ensure repayments are made or enter into a Division 7a loan agreement

Other considerations

- Planning for one off transactions – e.g. Business sales or purchases

- Self-managed Super Fund (SMSF) – do you have a SMSF? Consider the impact on the business

- Purchase of property or business premises

- Consider relevance of existing accounting systems and consider new technology

- ESG reporting – this begins in January 2025

CCIWA and Optima Partners are here to support your business at whatever stage you are at.

We offer a one-hour free consultation where you can discuss your unique circumstances and provide insights into possible strategies specific to your business. For more email: [email protected]