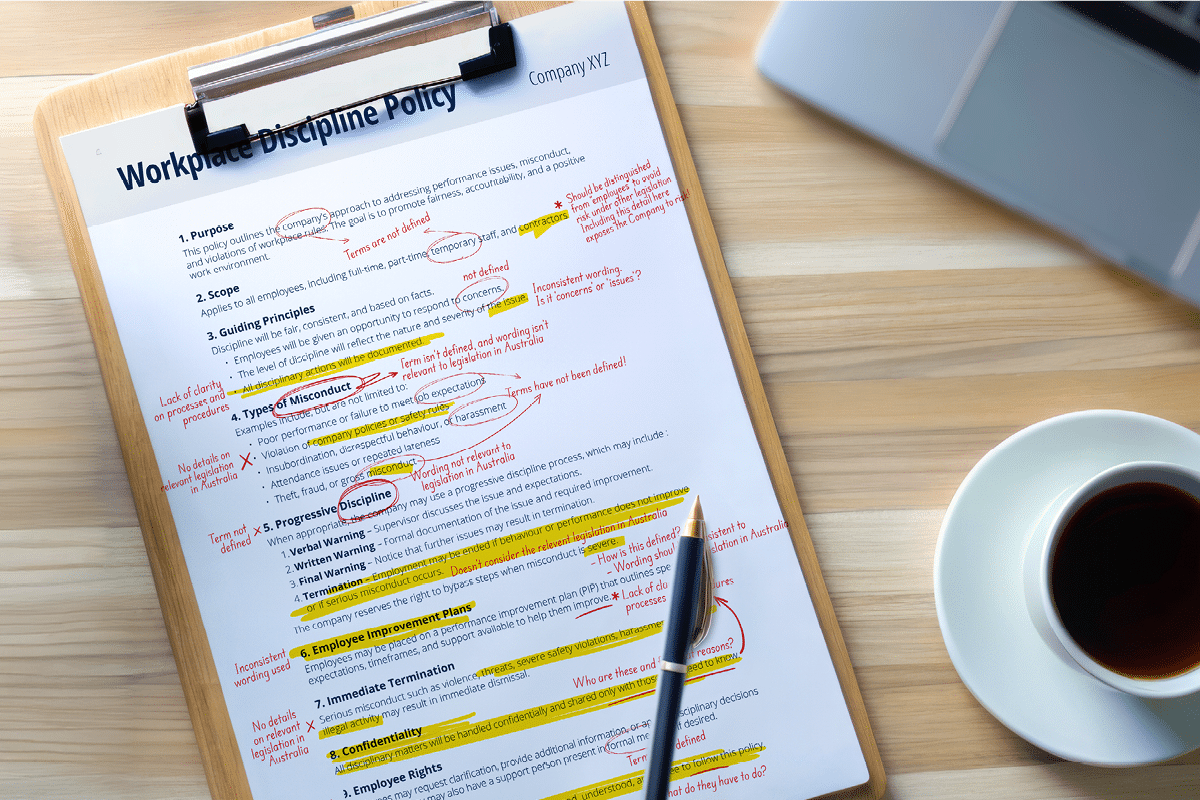

If your business faces an underpayment claim, it is best to resolve it early - but that may not always be possible.

Knowing the steps to take when such claims arise can equip employers to make informed decisions.

CCIWA Principal Workplace Relations Advocate Paul Moss explains the different ways underpayments can be resolved.

An underpayment claim will generally come in writing from the employee or by a representative on their behalf.

The Fair Work Ombudsman (FWO), a law firm or a union can pen this letter.

Though the tone will vary, a letter of demand spells out the reasons a worker believes they have been underpaid and the amount they believe they were underpaid.

As Moss advises, contacting CCIWA at this stage can prove very helpful for an employer.

“When businesses receive those letters, our advice is to then have a conversation with us…to identify whether the claim is a valid one…(and to determine)…the best way to respond or to deal with it,” he says.

You may be able to deal with a matter when it first arises, by resolving it with a worker or their representative individually.

Alternatively, the matter may progress to the FWO or to the courts.

If an underpayment claim cannot be resolved informally, there are several ways the FWO may handle it.

In most cases the regulator engages the parties a voluntary mediation process, which usually occurs over the phone.

If it is still not resolved, the FWO may be compelled to investigate the matter further or decide there is no basis to the claim and not pursue it any further.

An FWO investigation can take the following forms:

- Compliance notice

This details the extent of a breach and outlines how an employer can rectify it. An alternative to initiating legal proceedings, a compliance notice provides a deadline for employers to fix an underpayment issue by compensating affected staff.

- Enforceable undertaking

Described as a deed between the FWO and an employer to rectify an underpayment in a prescribed manner, this approach is normally taken where an employer recognises there is an issue.

An enforceable undertaking directs an employer to undertake certain activities to prevent the circumstances that led to the underpayment from occurring.

In addition to paying back the underpaid amounts, enforceable undertakings often involve some form of contrition payment and can include a donation to a charity.

When the ABC underpaid its staff $12m between 2021 and 2019, it signed an enforceable undertaking from the FWO to pay its workers back with interest, conduct annual audits, an external review and place notices on its social media.

- Prosecution

The FWO will preference enforceable undertakings in most matters, but serious claims may be progressed to the Federal Court.

As Moss explains, the disadvantage for employers of going down the prosecution path is the greater penalties involved.

“The FWO cannot issue a monetary penalty, other than an on-the-spot fine for failing to keep records, which is a very small amount,” he says.

“It is only at the prosecution stage that there is the risk of penalties in addition to (repaying the) underpayment.”

Under proposed reforms, small businesses face fines of up to $99,000 and corporations can be fined $5.5 million and/or a jail term.

If a claim is made through a union or law firm, an underpayment claim may progress to the WA Magistrates Court.

Not as commonly utilised as the Federal Court, this jurisdiction often takes less time to resolve a matter.

From here, a claim can still be progressed to the Federal Court to be resolved.

A proposed amendment to the Fair Work Act aimed to allow the Federal Court to refer matters involving $50,000 or less to be referred to the Fair Work Commission for faster resolution - but this did not pass.

Members of the Federal Court will initially attempt to resolve a matter via a mediation process before it reaches the complex arbitration process.

If this fails, it moves onto a hearing and determination, during which the parties will file submissions and evidence relating to a claim.

Moss says this can be an expensive process for both parties to initiate and can lead to significant penalties for employers if prosecuted.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus,

For advice and guidance on this issue, contact CCIWA’s Employment Relations Advice Centre on 9365 7660.