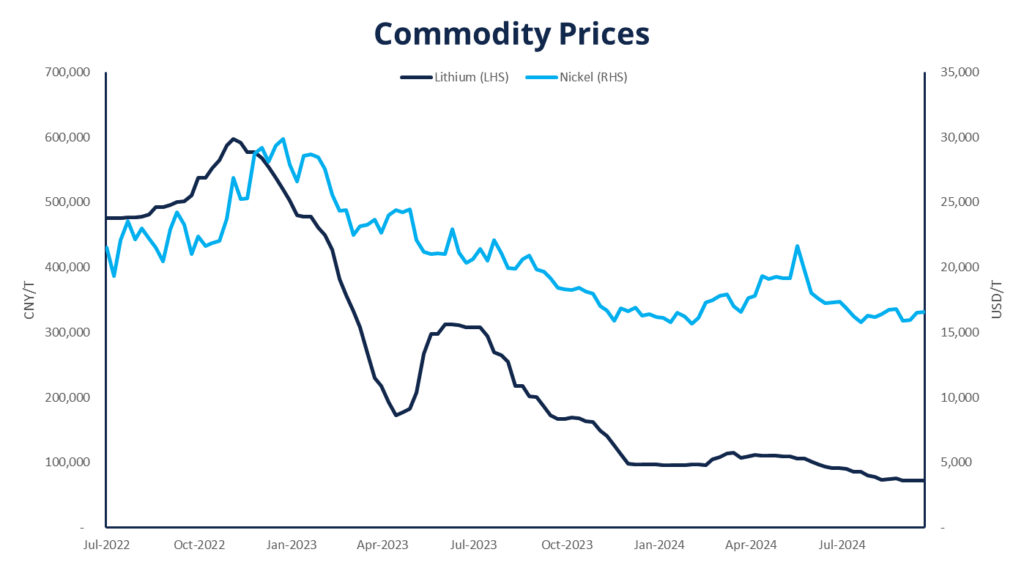

WA’s minerals sector has seen major changes in recent months, namely drops in iron ore, lithium and nickel prices, leading to projects closing or scaling down and job cuts.

While iron ore prices have fallen by about 30% since the beginning of the year, CCIWA’s Outlook September 2024 report predicts that the sector can withstand the current price softness as WA miners are among the lowest cost producers in the world.

By comparison, Australian lithium stocks soared earlier this month, following major Chinese miner CATL cutting production due to the low prices.

It led to WA lithium companies experiencing double-digit gains on the day of CATL’s announcement, including Mineral Resources (up 17%) and Liontown Resources (up 15%).

- Source: Refinitiv Workspace

- Source: Trading Economics

Increasing need to diversify

“Iron ore will continue to play a huge role in this State’s economy, but the volatility we’ve seen in the minerals market recently is a clear example of why it never pays to have all your eggs in one basket,” he says.

“WA’s economy needs to be as diverse as possible, both within the resources sector and beyond it.”

Morey says WA needs to continue to develop its capacity in critical minerals and rare earths, and consider the opportunities to export WA’s uranium as the world looks to reduce its carbon emissions.

“To do this, we need the right policy settings to get new projects off the ground,” he says.

“The Federal Government’s ‘Nature Positive’ reforms risk taking Australia in the wrong direction, making it harder to develop new projects to diversify our economy.”

Emerging iron ore markets

As China’s slowing economy has softened iron ore demand, ECU Senior Lecturer in International Business Dr Naoise McDonagh anticipates other emerging economies, like India – supported by the Australia-India Comprehensive Economic Cooperation Agreement that’s anticipated to be finalised this year – and Southeast Asia, will become stronger markets for WA iron ore.

McDonagh says he does not foresee India being “the new China” for iron ore but “it certainly has the population mass, low rate of urbanisation and need for new infrastructure to become a growing iron ore destination”.

“Going forward, the days of booming growth are likely gone in terms of the Australian-China iron ore trade, but there'll be stable ongoing demand for iron ore overall in the region, and WA is well-placed to take advantage by having the highest quality, lowest cost production,” he says.

Geopolitics to affect long-term supply chains

The US has heavily increased tariffs on Chinese EV imports to 100%. He notes that from 2025 EVs produced anywhere in the world that contain critical minerals extracted or processed by a Chinese firm or a foreign firm with 25% or greater Chinese equity will be ineligible to receive Inflation Reduction Act subsidies.

This criteria will impact Australian producers that meet the 25% or more Chinese equity threshold.

“A lot of Australian producers send their lithium to China to be processed – that won’t be able to go to North America at all,” McDonagh says.

“The biggest current market for lithium is clearly China, it’s the biggest producer and consumer of EVs and products that take critical minerals. But friend-shoring policy is set to change markets dramatically in the coming decade.

“With lithium and nickel in particular, the US, EU and China have all global market power to impact these markets, and they're all doing different things at the regulatory level that are going to impact Australia, and Australia will have to adapt.”

McDonagh encourages businesses in the critical minerals sector and supply chain to understand the market trends and have a strategic roadmap on where they will be in 10-15 years’ time, as the US and EU plan to exclude China from their supply chains.

BHP diversifying with copper, potash

When reporting on BHP’s annual results, CEO Mike Henry said while the company’s “position remains absolutely unchanged when it comes to iron ore”, it will “look at expansion in copper across the portfolio”.

BHP’s long-term focus will be on its copper (in South Australia, Chile and Argentina) and potash (in Canada) projects as it expects global demand for both commodities to increase by about 70% by 2050.

“Population growth, urbanisation, rising living standards and, increasingly, the infrastructure of decarbonisation are expected to drive demand for steel, non-ferrous metals, and fertilisers for decades to come,” Henry said.

Australia is the world’s eighth largest producer of copper, with most mines in SA and Queensland, according to the US Geological Survey.

Seven companies have attempted potash projects in Western Australia over almost two decades and are yet to reach substantial production.

Three companies went into administration, citing a lack of investment and declining market value as the cause.

Australia currently imports all its potash requirements, mostly sourcing sulphate of potash (SoP) from China and muriate of potash (MoP) from Canada, Russia and Belarus.

Almost all of Australia’s potash reserves are in WA’s Pilbara and Mid West.

This is a complimentary WA Works article. For more of this content, including updates on major projects and analysis on supply chains and project issues, subscribe to WA Works.

A subscription includes any-time access to our Major WA Projects List – the most comprehensive and up-to-date list of major projects across the State.