News & Media

Categories

Filter by category

Results found: 1708

Study looks at food and beverage businesses’ energy needs

WA food and beverage manufacturers can access free scope 1 and 2 emissions support and industry insights through the Energy Snapshot Study. The survey closes...

Learn more

CCIWA puts inclusive employment in action at Good Sammy

CCIWA at Good Sammy's corporate volunteering day highlighted how inclusive employment and sustainable business practices can operate together.

Learn more

How defence and the APS are opening doors for people with disability

RecruitAbility gives candidates the option to identify if they have any disability that could impact how they undertake tasks in the workplace.

Learn more

International Day of People with Disabilities – From celebration to action

CCIWA is excited to work closely with industry, government and community partners to build momentum around inclusive employment.

Learn more

Unlock the power of inclusive employment: The Right Fit program

Explore the Right Fit program to receive individualised support to elevate employee experience and embed practical, sustainable inclusion strategies.

Learn more

Employment Workshop Launch to foster inclusivity

Employment Workshop will be held to increase employment opportunities for people with disability and support employers to build inclusive teams.

Learn more

Celebrate excellence in disability support across WA

The WA Disability Support Awards celebrate individuals and organisations who are improving quality of life and wellbeing of people with disability.

Learn more

WA key player in US-led critical minerals push

Australia’s refreshed Critical Minerals Prospectus highlights WA as a key player in a US-led push to strengthen allied supply chains and attract global investment.

Learn more

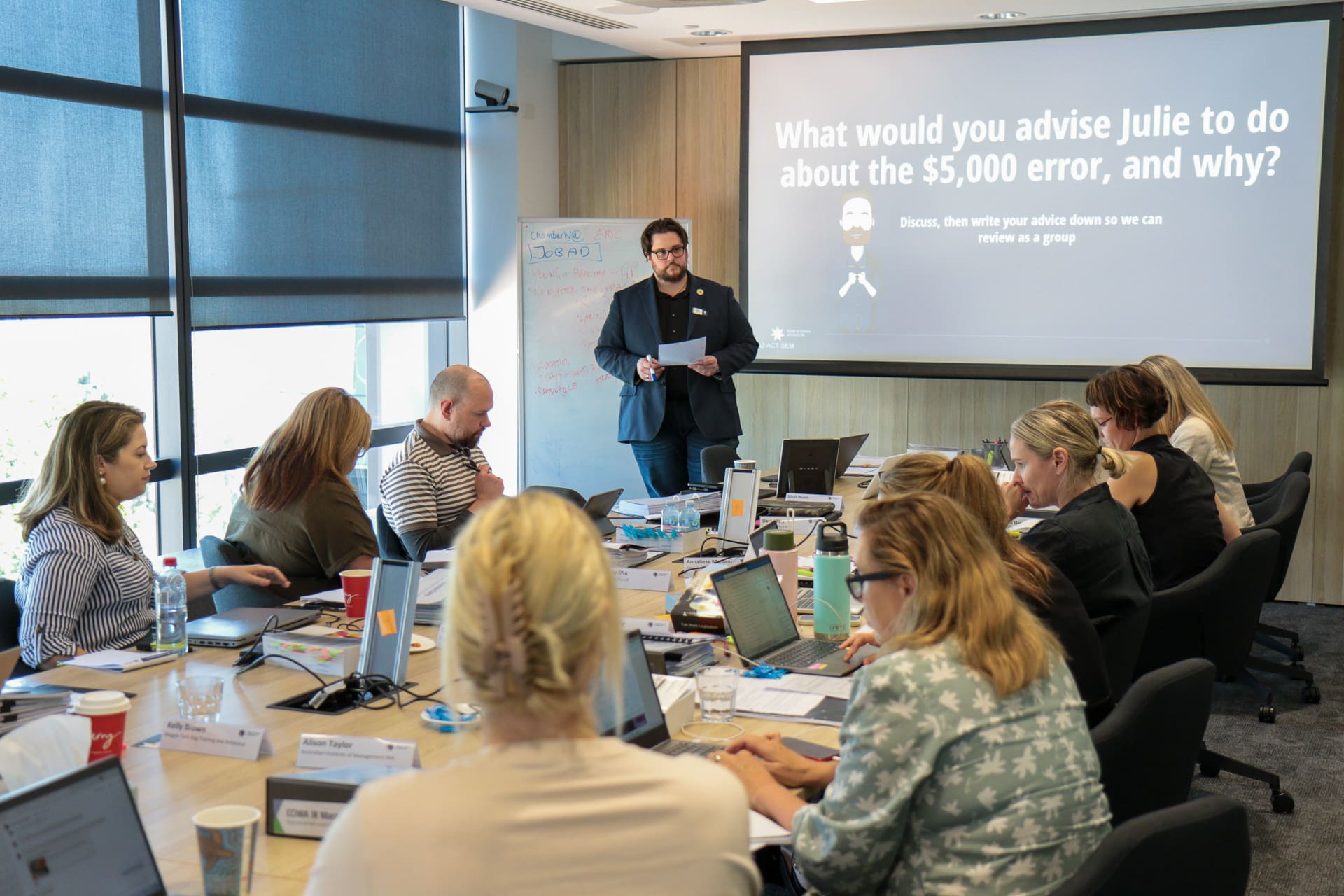

Avoid common HR pitfalls: Join our IR Masterclass

CCIWA's HR Masterclass helps WA business to overcome compliance risks and relieve workplace regulation pressures.

Learn more

EPA recommendation important step to secure energy supplies

The recommendation to approve of exploratory drilling for gas in the Kimberley will open up significant economic opportunities for the region, the state and the...

Learn more

Statement regarding Tim Picton

Comments attributable to Nicki Ivory, CCIWA President. “On behalf of the Chamber of Commerce and Industry WA (CCIWA), I extend my heartfelt condolences to the...

Learn more

New national trade network to support export diversification

Austrade’s new Trade Diversification Network will help WA exporters enter new markets, supporting trade missions, training and access to global opportunities.

Learn more