STATE BUDGET ANALYSIS 2022

State Budget delivers the quinella

OUR VERDICT

The Budget delivers a critical quinella: significant improvements in the State’s net debt position, and some solid reform measures directly called for by CCIWA.

This financial year state net debt will fall below $30 billion for the first time since 2015.

On the reform front, some of the critical initiatives that CCIWA has called for include a boost to the Digital Capability Fund, more overseas trade and investment offices, and some small but important reforms to the State’s taxation arrangements.

These are welcome measures. But there are bigger reform opportunities still on the table, including a more competitive payroll tax system.

All up, the Government has made good decisions as part of this Budget. We look forward to working further with them on driving more reform opportunities.

BUDGET BY NUMBERS

Soaring iron ore royalties and GST payments deliver $5.7b surplus in 2021-22

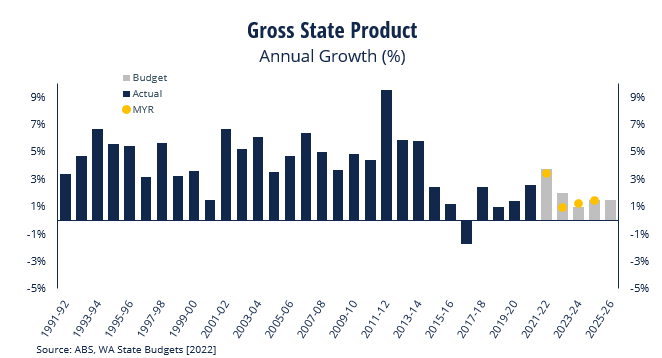

Western Australia’s economy — measured by Gross State Product — is expected to grow by 3.75 per cent this financial year and 2.0 per cent in 2022-23.

If this growth is achieved, it will have been driven by robust business investment, infrastructure spending and strong household consumption.

WA’s labour market is expected to remain red-hot, with unemployment to average 3.75 per cent in each of the four years to 2025-26.

While inflation is expected to hit 4.0 per cent over this financial year — underpinned by supply chain disruptions, the Russo-Ukraine war and strong global demand — the pace of inflation is expected to cool slightly in 2022-23 (+2.75 per cent) and hold steady across the forecast horizon (at 2.5 per cent).

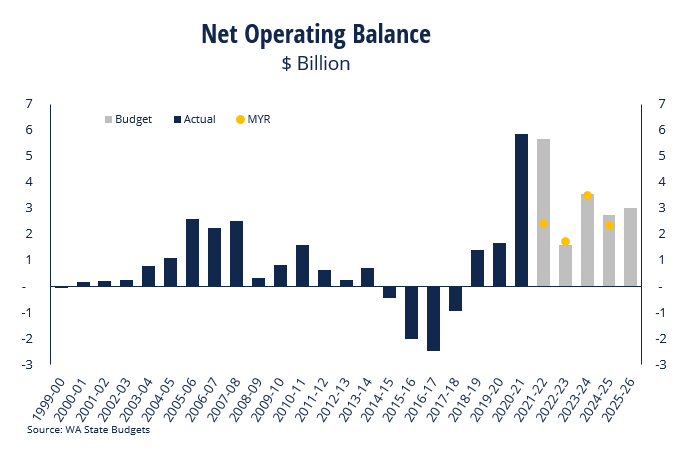

Soaring commodity prices, stamp duty receipts and GST collections have boosted the State’s financial position, with the WA Government expected to print a final operating surplus of $5.7b this financial year — a near record high — and $1.6b in 2022-23.

After accounting for infrastructure spending, the Government is expecting to record a cash surplus of $3.8b this financial year. Cash deficits are forecast until 2024-25, primarily reflecting conservative iron ore price forecasts and a ramp up in the Government’s asset investment program.

COST IMPACTS

There is temporary support for households to cope with rising cost of living pressures in the form of a $400 electricity credit.

For small businesses however, the Budget delivers a 2.6 per cent increase in costs, driven by increasing utility costs and motor vehicle licensing fees and charges.

To lower the costs of doing business in WA, CCIWA urges the government to reform WA’s payroll tax model and allow more competition in retail electricity markets for small and medium businesses.

POSITIONING WA INTERNATIONALLY

Capitalising on climate opportunities and pushing back into overseas markets

Major budget measures include:

- $652 million to boost WA’s climate credentials, including $60m for an electric vehicle package and $31m for climate research and planning.

- Establishing four more overseas trade offices in Frankfurt, Chennai, Ho Chi Minh City and Kuala Lumpur.

- $121m to support rebuilding our tourism and international education sectors.

INVESTING IN INFRASTRUCTURE

A significant boost for regional infrastructure

Major budget measures include:

- Over $1.4b for regional roads, rail freight and telecommunications infrastructure.

- Over $500m investment in regional ports, including Geraldton and Port Hedland.

- $50m to develop strategic industrial land precincts.

ENSURING A SKILLED WORKFORCE

Heading in the right direction: attracting overseas workers

Major budget measures include:

- $189.5m from 2022 to 2025 for providing WA children with 15 hours per week of kindy, with funding to follow the child, as per the newly signed National Preschool Reform Agreement.

- A commitment to request that the Federal Government include building and construction trades on the PMSOL, and an overseas marketing campaign to attract workers from the UK and Ireland.

- $11m to build WA’s defence industry workforce, and $2.4m to attract international students to regional WA to alleviate skills shortages in aged and disability care, childcare and hospitality.

KEEPING THE COSTS OF DOING BUSINESS LOW

Welcome efforts to reduce red-tape and boost cashflow

Major budget measures include:

- $400m more for the Digital Capability Fund to drive efficiencies in government service delivery, including data linkages across agencies, and improved cybersecurity.

- Tweaks to the tax system to reduce red-tape and help cashflow, including allowing more businesses to pay payroll tax quarterly, removing the 2 per cent surcharge for paying land tax in three installments, and reducing the general rate of transfer duty.

- Relief on various other duties and fees, including a payroll tax waiver for hospitality businesses with a 40 per cent drop in turnover between January 1 and April 30.

CCIWA will continue to fight for reforms that advance trade and commerce in this State. To view the full suite of our policy recommendations to the State Government, download our pre-budget submission.

Making paid work pay for families

Making the most of the workforce we have available is more important than ever. And for WA, the scope for gains is enormous.

Workplace Health and Safety

Cost-effective solutions to manage your WHS needs, reduce the risk to your workers and help you meet WA WHS laws.

ANZ & CCIWA Economic Breakfast

Hear from ANZ Chief Economist and Head of Research, Richard Yetsenga, providing his insights on economic trends for 2022.