Payroll Tax: An Unfair Burden

WA has the highest payroll tax burden of any state, which is making it harder for small and medium enterprises to do business. It’s impacting the creation of new jobs and investment in WA, putting WA businesses at a competitive disadvantage to businesses in other states. It’s like our businesses have to compete with one arm tied behind their back.

This is what some WA businesses have to say about payroll tax

Fact #2:

The number of employing businesses in WA paying payroll tax is climbing

Around 27% of employing businesses^ in WA pay payroll tax, and that number is growing as wages continue to climb.

And even businesses that don’t pay it yet are concerned.

“As a small business the prospect of having to pay payroll tax is nearing and it’s impacting our decision to employ more people.”

Professional Services,

8 employees.

^ Calculated by using percentage of all businesses paying payroll tax as quoted by Premier Roger Cook in Business News (10%), then using this number to find the proportion of employing businesses.

Fact #3:

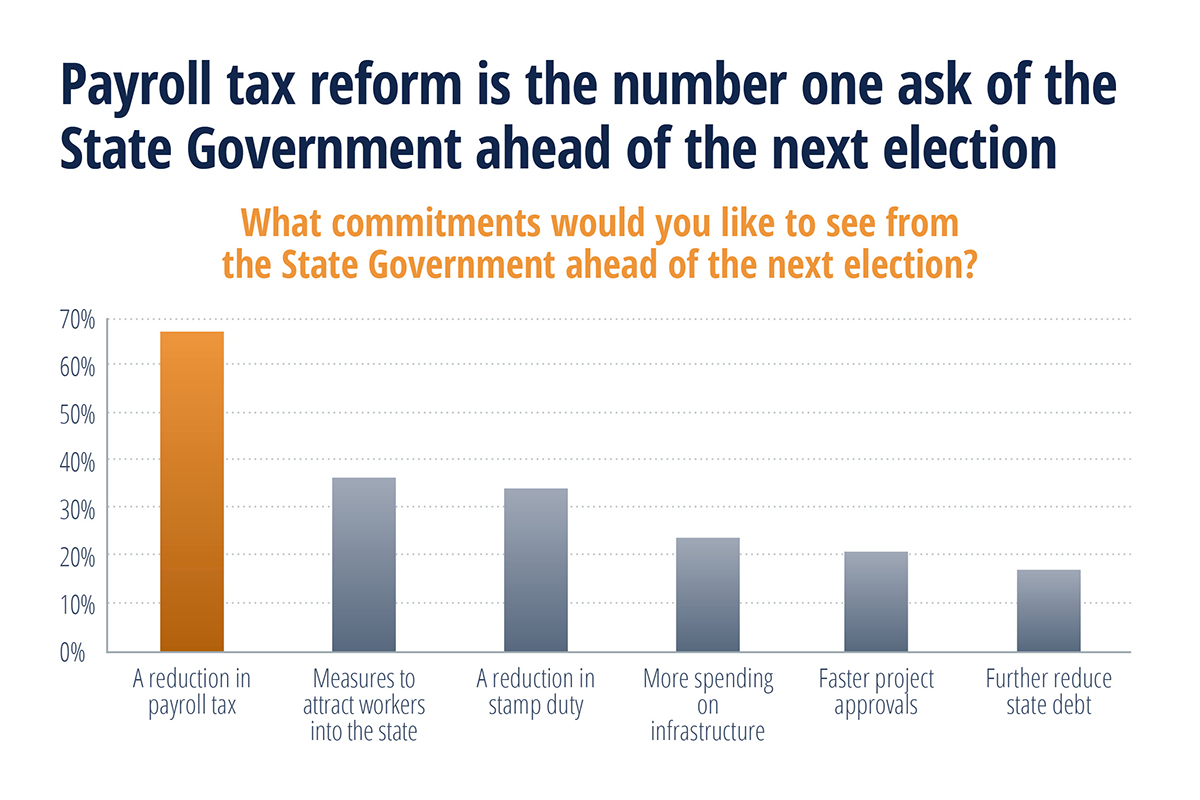

The overwhelming majority of businesses in WA want payroll tax reform

How do you compare? Do you think it’s fair?

Our interactive Payroll Tax Calculator gives you an immediate visual representation of the disparity regarding Payroll Tax.

Enter your total gross annual wages to see how your payroll tax liability compares to organisations like yours in other states.

Note: Minimum gross annual wage must be at least $1,000,000

Hear from CCIWA Chief Economist, Aaron Morey

Join our campaign

We are calling for the tax on jobs to be reduced by the State Government as a priority. With over 130 years proven success advocating for changes that make WA the best place to live and do business, we have the influential relationships and trust with the people that matter most.

It’s critical that you have a voice that is listened to, because your voice makes a difference. By working together, we can ensure you are heard.

Share your story and help us fight for fairness.

* Required