The Federal Government delivers its first budget surplus in 15 years, a strong result primarily driven by the business community.

The Federal Government delivers its first budget surplus in 15 years, a strong result primarily driven by the business community.

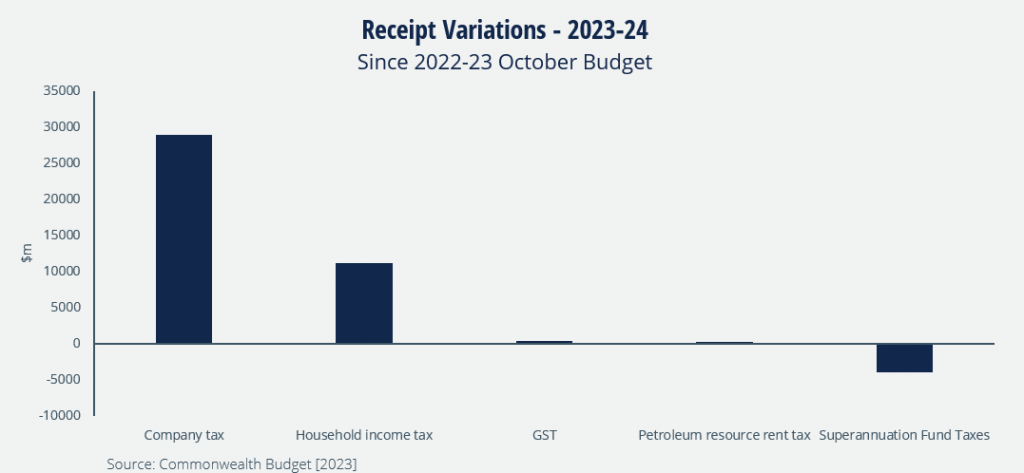

The $4 billion surplus is bolstered by higher company tax, with the greatest spending pressures being the NDIS and interest payments.

“Australia’s Budget will be in surplus for the first time in 15 years, and national debt has been significantly revised down,” says CCIWA Chief Economist Aaron Morey.

“A key driver of the turnaround was a $51.8 billion surge in corporate tax paid by business, a reminder that the business community is vital to Australia’s fortunes.

CCIWA commends the Government for committing much of the revenue windfall to reduce debt, instead of increasing the structural deficit.

Morey says this is a strong outcome that will recede as cost pressures take over.

“Although improved, our gross debt will still reach $1.1 trillion and does not peak within the next four years.

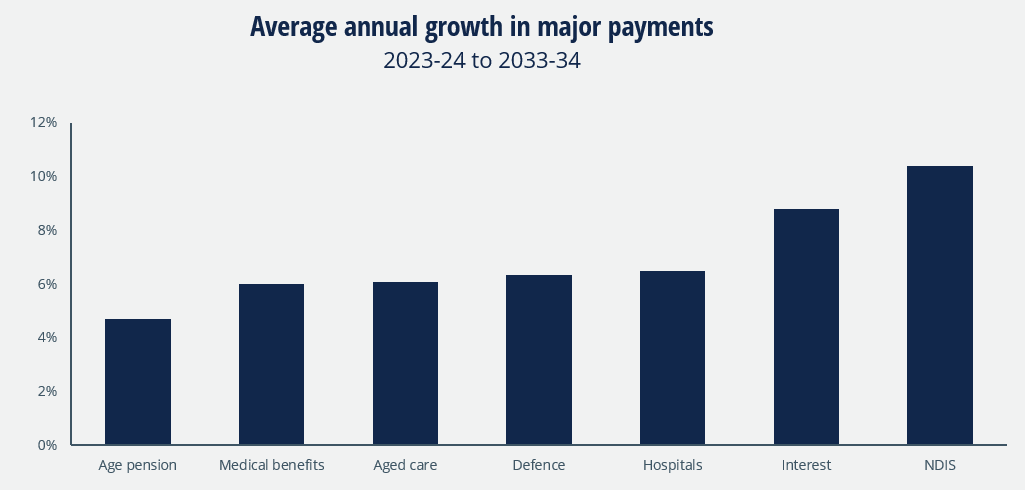

“Demands for spending increase 10.4% per year for the national disability insurance scheme, 6.5% per year for hospitals, 6.1% for aged care and 6.4% for defence, putting us back in the red.

“Strained by costs and inflation, our economic growth will drop to a disappointing 1.5% next year.

Morey cautions the Budget may hinder future projects in mining, resources and energy getting off the ground, with prolonged approvals, price caps, tax changes and regulatory interventions.

“Wholesale shifts to our workplace relations laws, including the introduction of multi-employer bargaining and the mooted ‘same-job same-pay provisions’, also loom as a significant drag on our economy,” he says.

“To return to a sustained surplus in future, we should build on our strengths, through further initiatives to facilitate critical investment, including by moving with the world and supporting carbon capture and storage, introducing productivity-enhancing reforms, and reforming environmental approvals.”

Here’s what the Federal Budget means for WA business:

- Energy price relief: The Government is partnering with state and territory governments to deliver up to $3b of electricity bill relief for eligible households and small businesses. From July 2023, this plan will deliver up to $500 in electricity bill relief for eligible households and up to $650 for eligible small businesses – co-funded with the states and territories.

- Climate change: This Government will allocate $4b to support Australia’s plan to become a renewable energy superpower, taking total commitments to support decarbonisation to $10b. This includes $2b toward a Hydrogen Headstart program, $57.1m to develop Critical Minerals International Partnerships to secure strategic and commercial partnerships, and $38.2m to establish a Guarantee of Origin scheme to underpin markets for green energy, including hydrogen and other low emissions products.

- Furthering jobs and skills: The Government will commission Jobs and Skills Australia to undertake a Clean Energy Capacity Study to evaluate workforce needs and enable Australia to strategically plan for the skills needed for the transformation to a clean energy economy. The new National Skills Agreement (from 1 January 2024) will ensure Australia focuses on providing the right training for critical and emerging industries, and will deliver funding for 300,000 TAFE and vocational education training places to become fee free. In addition, $72.4m will be allocated to support the skills and training of workers in the early childhood education and care sector, including $34.4m to support educators to undertake professional development and $37.9m to provide financial assistance for educators to complete their practicum requirements for a Bachelor or postgraduate degree.

- SMEs: Small and medium enterprises will benefit from a $20,000 instant asset write-off for businesses with aggregated annual turnover of less than $10m. Just over two million eligible small businesses with also benefit from cashflow relief by halving the increase in their quarterly tax instalments for GST and income tax in 2023‑24. Nearly four million SMEs with aggregated annual turnover of less than $50m will also have access to a bonus 20% tax deduction for the cost of eligible depreciating assets, from 1 July 2023 until 30 June 2024. In addition, through the National Reconstruction Fund, the Government will establish a new $392.4m Industry Growth Program, which will support Australian SMEs and startups to commercialise their ideas and grow their operations.

- Boosting migration: CCIWA has been advocating strongly for a more responsive skilled migration system to enable businesses to get the skills they need. Changes include allocating around 70% of places in the 2023‑24 permanent Migration Program to skilled migrants, providing an extra two years of post‑study work rights to Temporary Graduate visa holders with select degrees, to improve the pipeline of skilled labour in key sectors as well as providing additional training places for Pacific Australia Labour Mobility scheme workers in priority sectors.

Economic outlook

Australia’s economic growth is expected to slow from 3.25% in 2022-23 to 1.5% the year after, then recover to 2.25% the following year.

The main drivers of economic growth are tipped to be exports and household consumption.

Inflation pressures are expected to ease from 6% this year to 3.25% next year.

“From energy bill relief to national defence, manufacturing to Medicare, investments in this Budget aim to make Australia more resilient and more secure in uncertain times,” says Treasurer the Hon Dr Jim Chalmers MP.

“Fundamental to this is our responsible economic management and our efforts to put the Budget on a stronger foundation.

“This Budget, we’ve returned 82% of the extra revenue windfall that’s largely come from lower unemployment, stronger jobs and wages growth, and higher prices for key exports.”

Want to keep up-to-date with the latest business news and advice? Become a CCIWA Member today and get access to exclusive information designed to help you do business better. Find out more here.