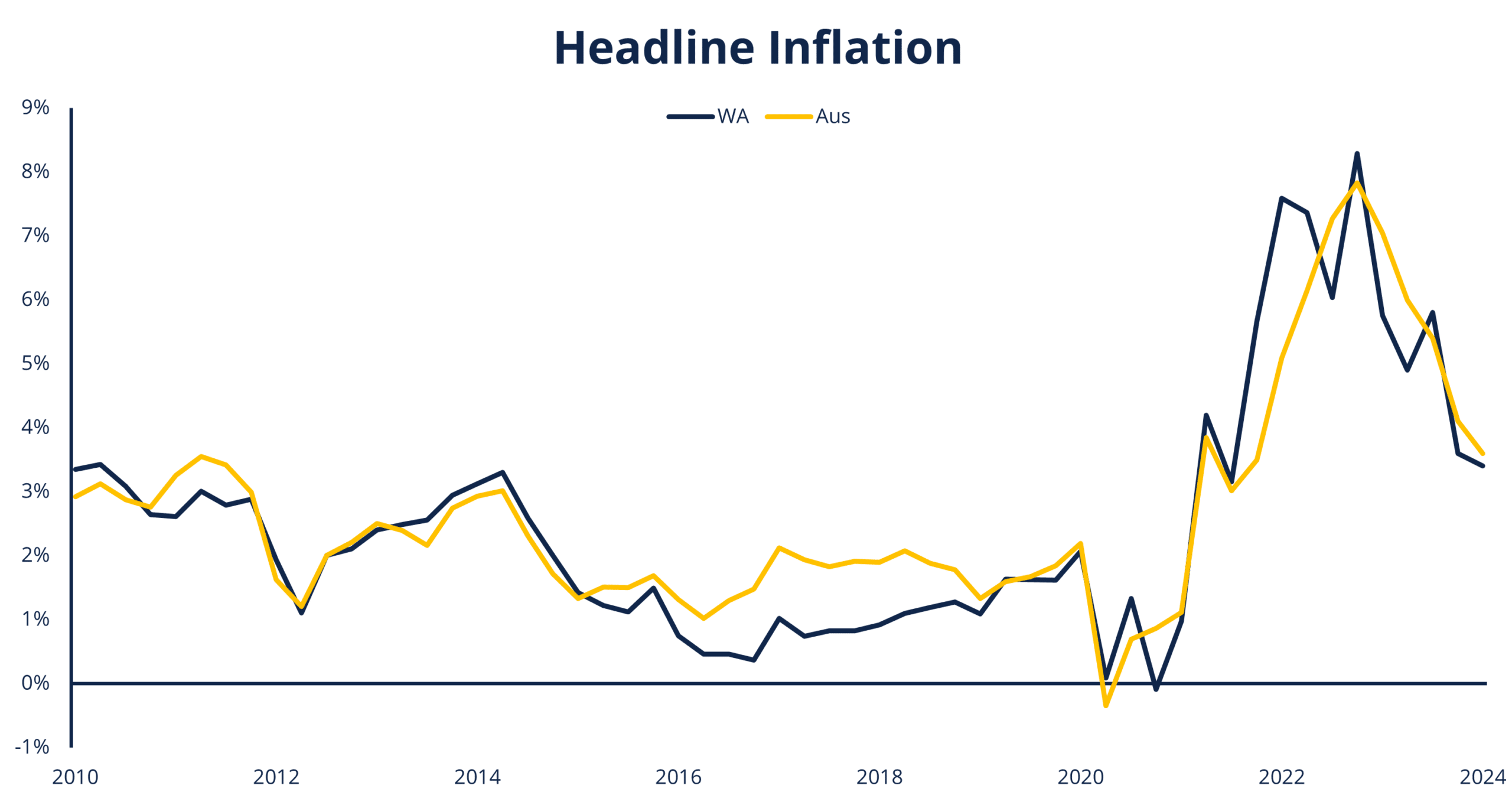

Nationally, the consumer price index (CPI) recorded a 1% rise over the March quarter, bringing inflation to 3.6% over the year to March. This is down 0.5 percentage points from the 4.1% reading in December but slightly higher than market expectations.

Prices continue to rise at a slower rate in Perth, with inflation reading 3.4% over the year to March, down from 3.6% in December last year. Over the quarter, CPI rose 0.6%, the lowest rise of all states. New house purchases (+3.6% quarter-on-quarter), rents (+2.9%) and education (+5%) were the primary drivers of Perth’s inflation this quarter, as the strong demand for housing and the start of the new school year saw increases here. On the flipside, electricity (-18.1%) and international holidays (-5.9%) were the key detractors.

WA’s labour market remaining unexpectedly resilient

WA’s labour market continues to defy expectations, with the unemployment rate dropping again to 3.4% in March – down from 3.6% in February. WA now has the lowest unemployment rate of all states and is well below the national rate of 3.8%.

The number of people employed in the State has risen to a new record high, while the number of hours worked also lifted over the month. In line with this, the number of people who are underemployed (or want to be working more hours) also fell a huge 14,500 in signs that the demand for workers remains strong.

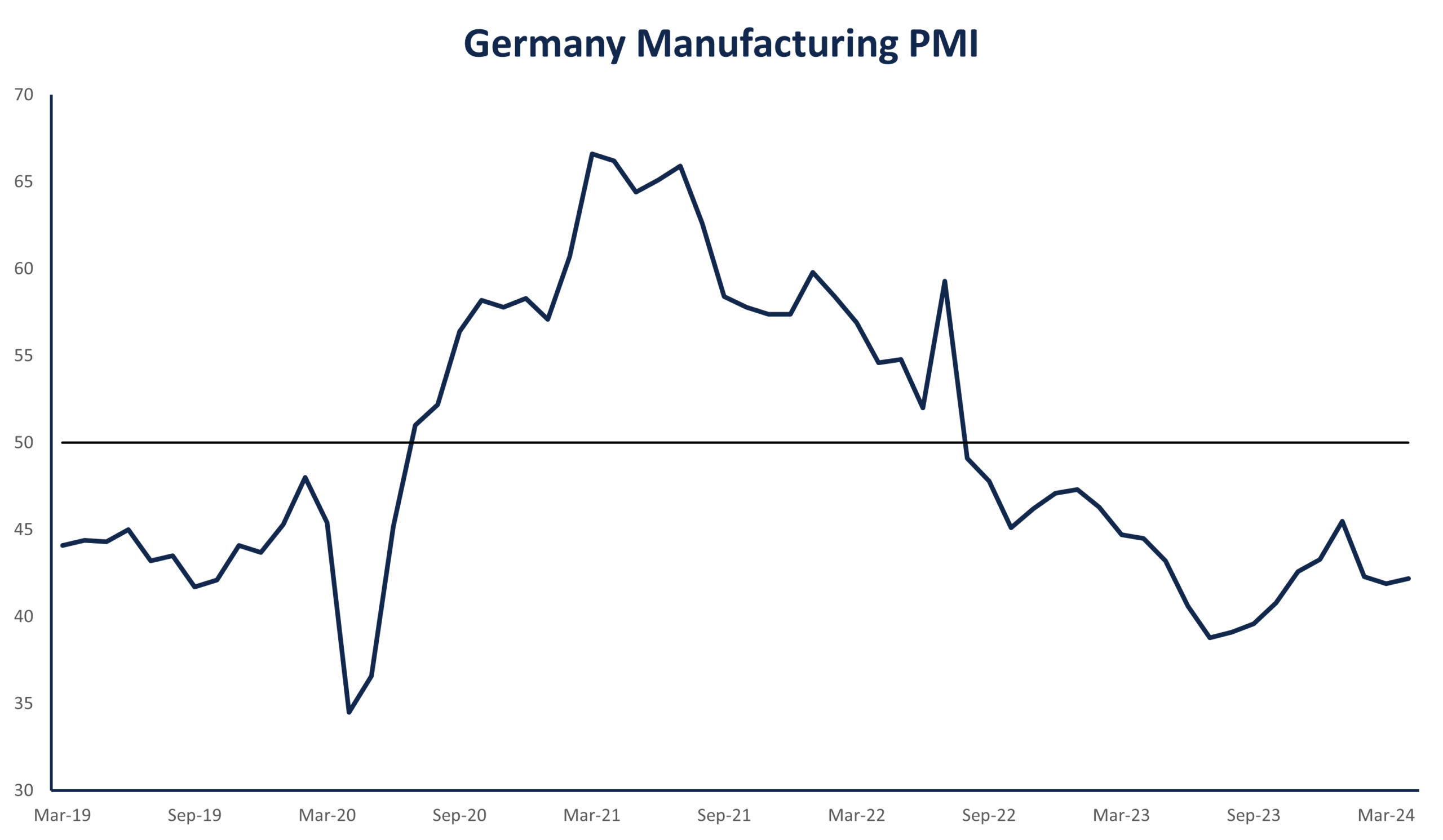

Germany’s industrial sector continues to contract

Overseas, Germany’s manufacturing purchasing mangers’ index (PMI) increased to 42.2 in April, up from 41.9 in March yet slightly below expectations of 42.8 (below 50 is considered contractionary). The reading continues to point to weak conditions in the industrial powerhouse’s manufacturing sector, with incoming orders experiencing the most significant decline in five months, signalling weakening demand. Encouragingly though, production fell at a slower pace, staff layoffs declined and producer prices fell.

CCIWA’s Economic reports are available exclusively to CCIWA Complete, Advantage and Corporate Members. For more see CCIWA’s Economic Insight page.