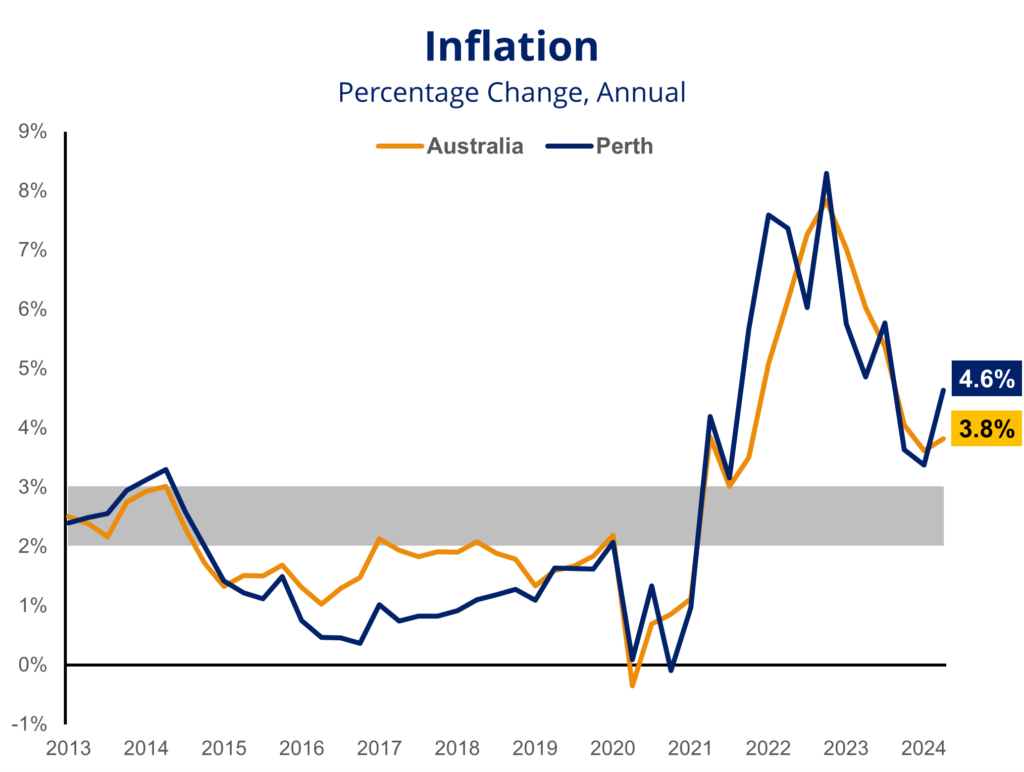

Inflation surged in Perth over the June quarter, rising 2.1% over the three months to June.

This pushes annual inflation to 4.6%, up from 3.4% recorded in March and is now the highest in the nation.

This rise was largely driven by the unwinding of electricity subsidies, with electricity costs rising 44% over the quarter. However, this was also driven by the significant pressure on other housing costs, with new housing purchases rising 4.9% over the three months and rents rising 2.8%.

At a national level, the annual inflation rate ticked up to 3.8%, from 3.6% in March. Despite the increase, this was broadly in line with expectations and was a key reason why the RBA left the cash rate unchanged earlier in the week.

Share markets plunge as US recession fears grow

The global share market experienced its worst two-day performance in more than two years this week, as fears of a US recession grew. Weaker than expected employment data out of the US late last week spooked investors, with the S&P500 index tumbling around 6%. The Australian market followed this, also dropping around 6% in the two days.

Building approvals continue to trend upwards

Building approvals data released last week revealed there were 1742 dwelling approvals over June in WA, down from the 1904 recorded in May.

Despite the fall, approvals remain 59% higher than this time last year, in a sign that new housing demand continues to be strong. This is in contrast to some of the bigger states, which are seeing a decline in approvals as higher house prices and weaker population growth have combined to quell demand.

CCIWA’s Economic reports are available exclusively to CCIWA Complete, Advantage and Corporate Members. For more see CCIWA’s Economic Insight page.