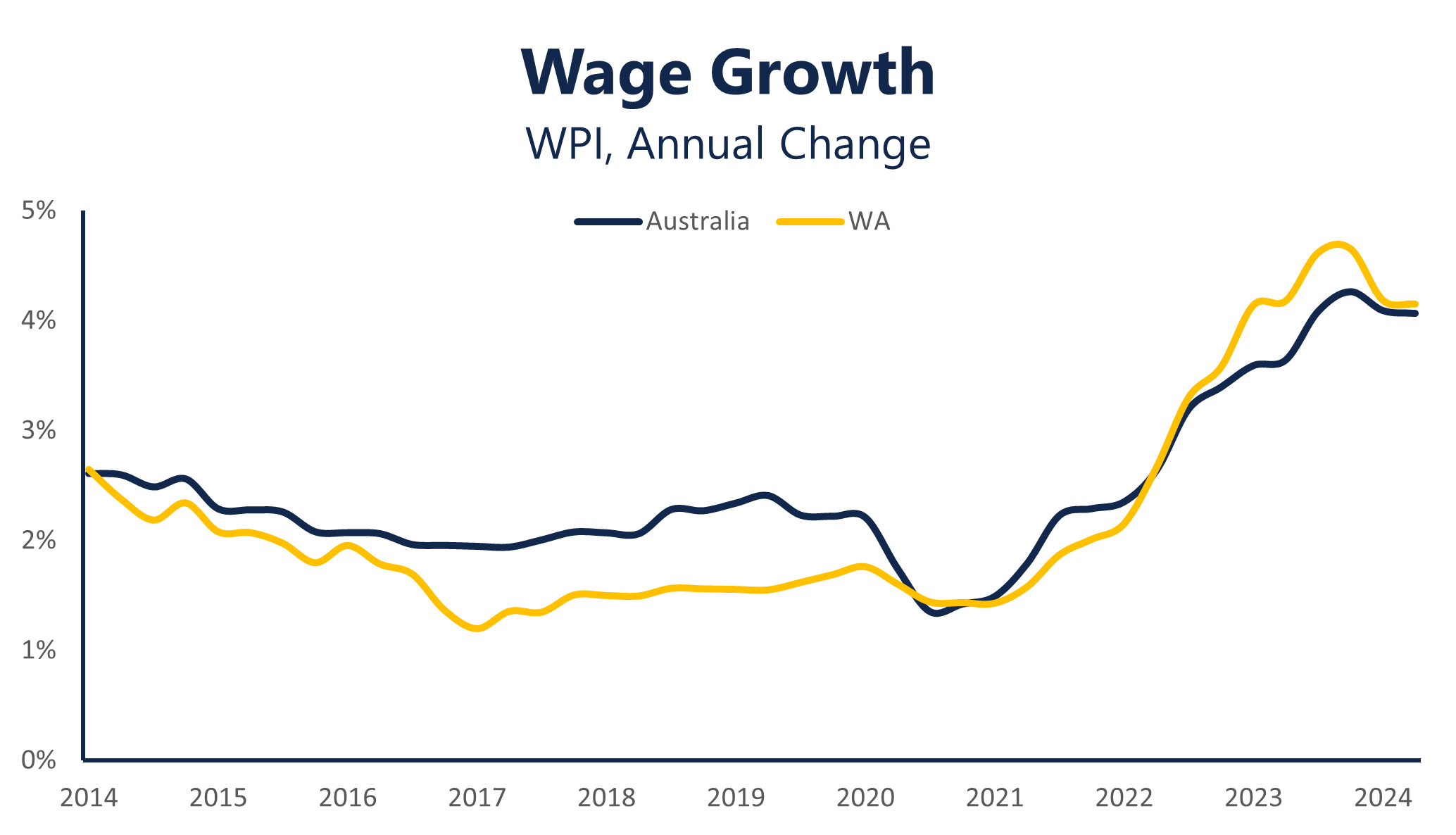

Wage growth has peaked in Western Australia, with the Wage Price Index (WPI) rising 4.2% over the year to June.

This is the same reading as the March quarter and down from the 4.7% recorded in December, in a sign that wage growth continues to moderate. Despite the modest slowdown, wages in WA are still growing faster than the national average, with the national WPI rising 4.1%.

At a state level, this continues to be driven by strong growth in the private sector, where wages increased 4.4% over the year, compared with a more modest 3.1% in the public sector. Wages growth should decline further over the rest of the year, as demand for workers gradually eases.

WA’s labour force hits fresh record high

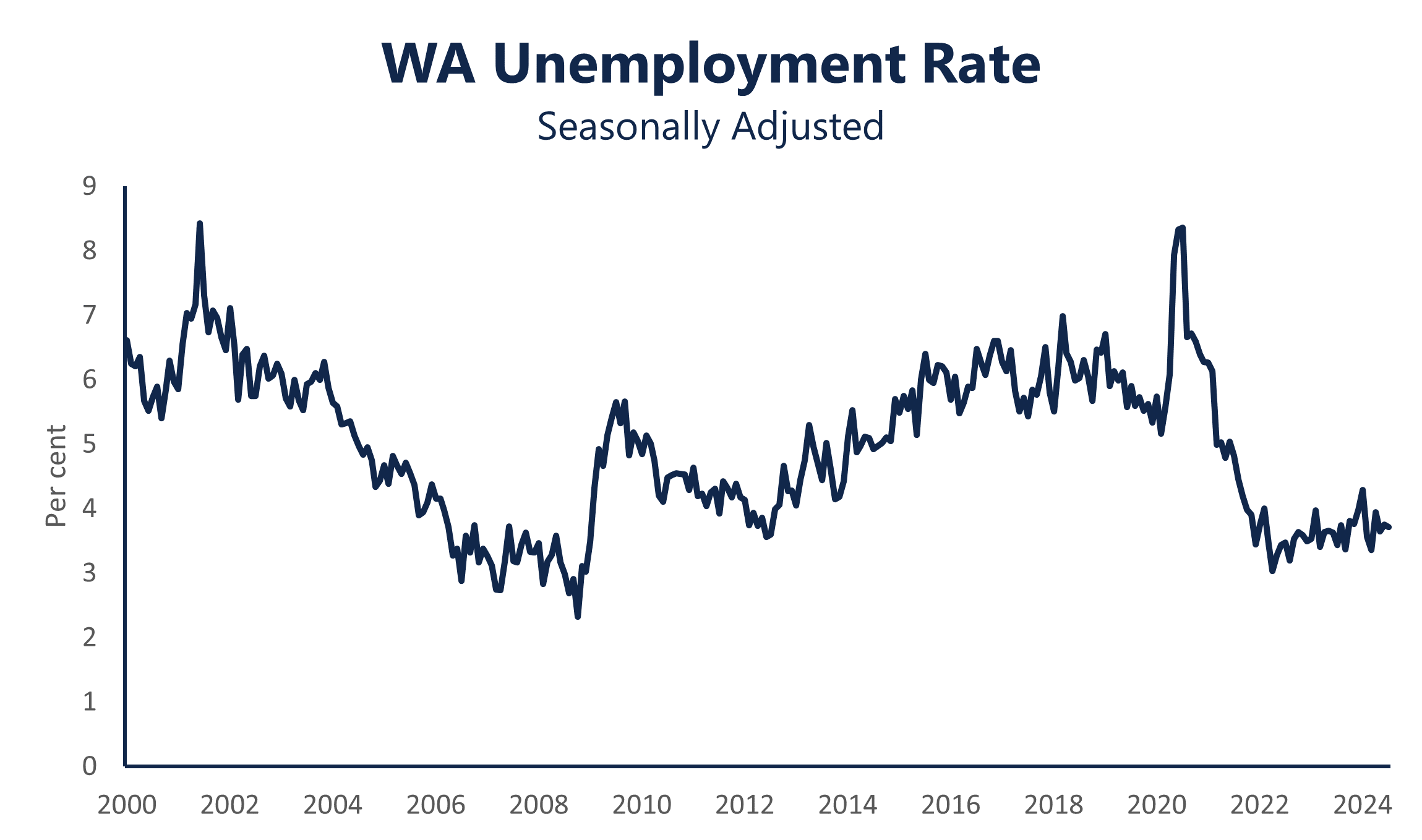

WA’s labour market remains robust, with the unemployment rate coming in at 3.7% over July, unchanged from the previous month. This is in contrast to the national figure, which rose to 4.2% and means WA once again has the lowest unemployment rate of all states and territories.

The number of people employed in WA rose by a solid 13,400, continuing to push the size of the workforce to record highs.

This was largely driven by an increase in part time employment, which rose by 11,000 people over the month. At the same time, the underemployment rate sits at a low 5.5%, indicating that most workers continue to work their desired hours and employers aren’t necessarily hoarding their workforce.

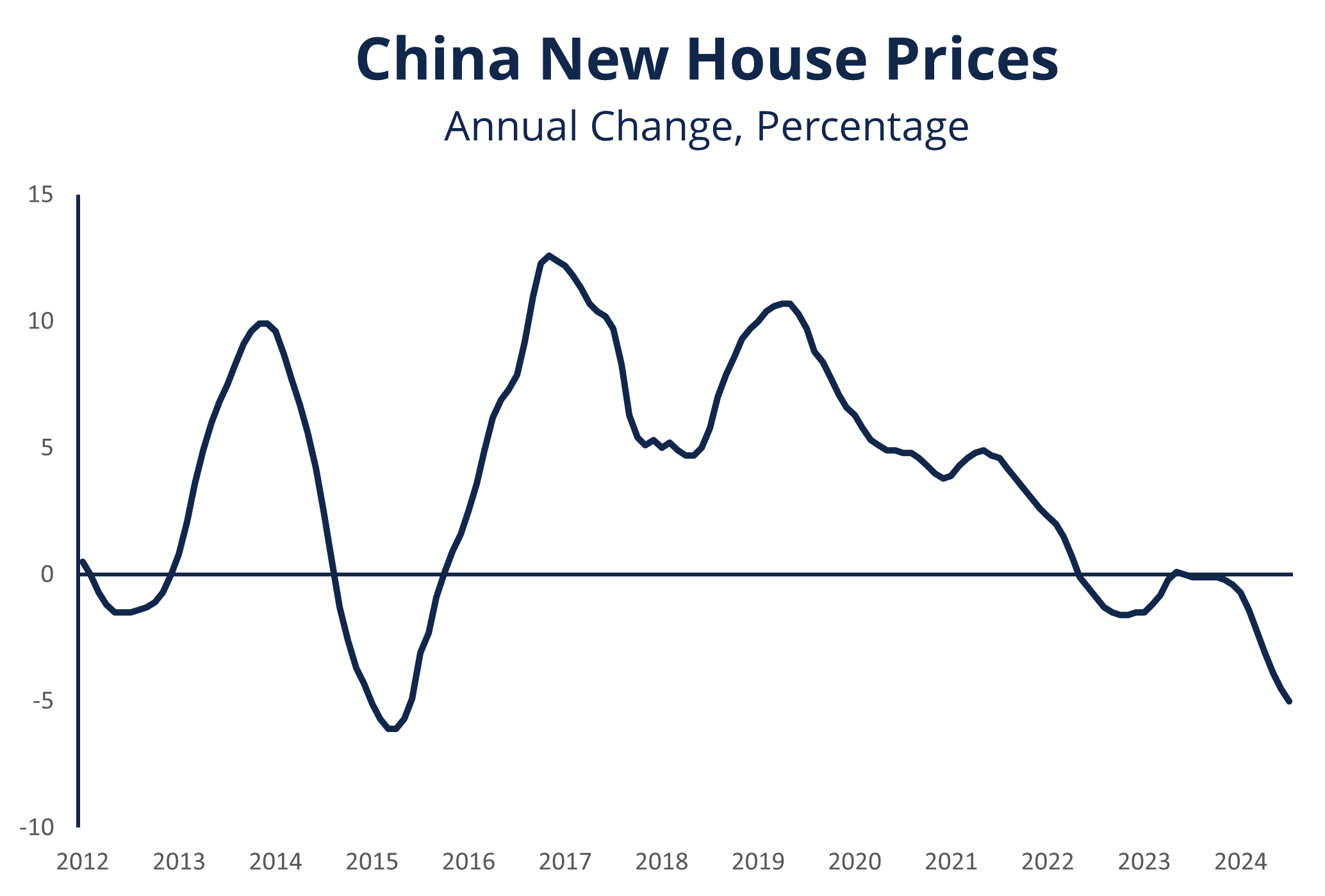

China’s house prices slip further

Overseas, China’s property sector slump continues, with fresh data showing new house prices have declined 5% over the year to July. This continues the sharp downward trend experienced since late last year and is the worst performance for house prices since 2015.

The fall in house prices is emblematic of the current problems in the property sector, with weak demand for housing being one reason activity has weakened.

Given China’s property sector accounts for approximately 30% of its steel use, this lacklustre activity has also seen demand for iron ore decline. This has pushed iron ore prices down more than 30% since the beginning of the year and remains a key risk to WA’s economic outlook.

CCIWA’s Economic reports are available exclusively to CCIWA Complete, Advantage and Corporate Members. For more see CCIWA’s Economic Insight page.