Data released last week showed Western Australia’s economy, as measured by gross state product (GSP), grew 0.5% in annual average terms over 2023-24. This was the weakest of all states and territories, and the lowest pace of growth since 2016-17.

This result was driven by a weak external sector, with net exports falling 7.8% over the year on the back of weaker production from the mining sector combined with strong import growth due to robust investment activity. However, domestic activity remains strong, with state final demand growing 5.8% over the year.

Indeed, the mining sector was the biggest drag on GSP growth, detracting 1.0 percentage points. Despite this, it remains the largest component of WA’s economy by some margin, contributing 44.8% on a gross value added basis – the second highest is construction at 5.4%.

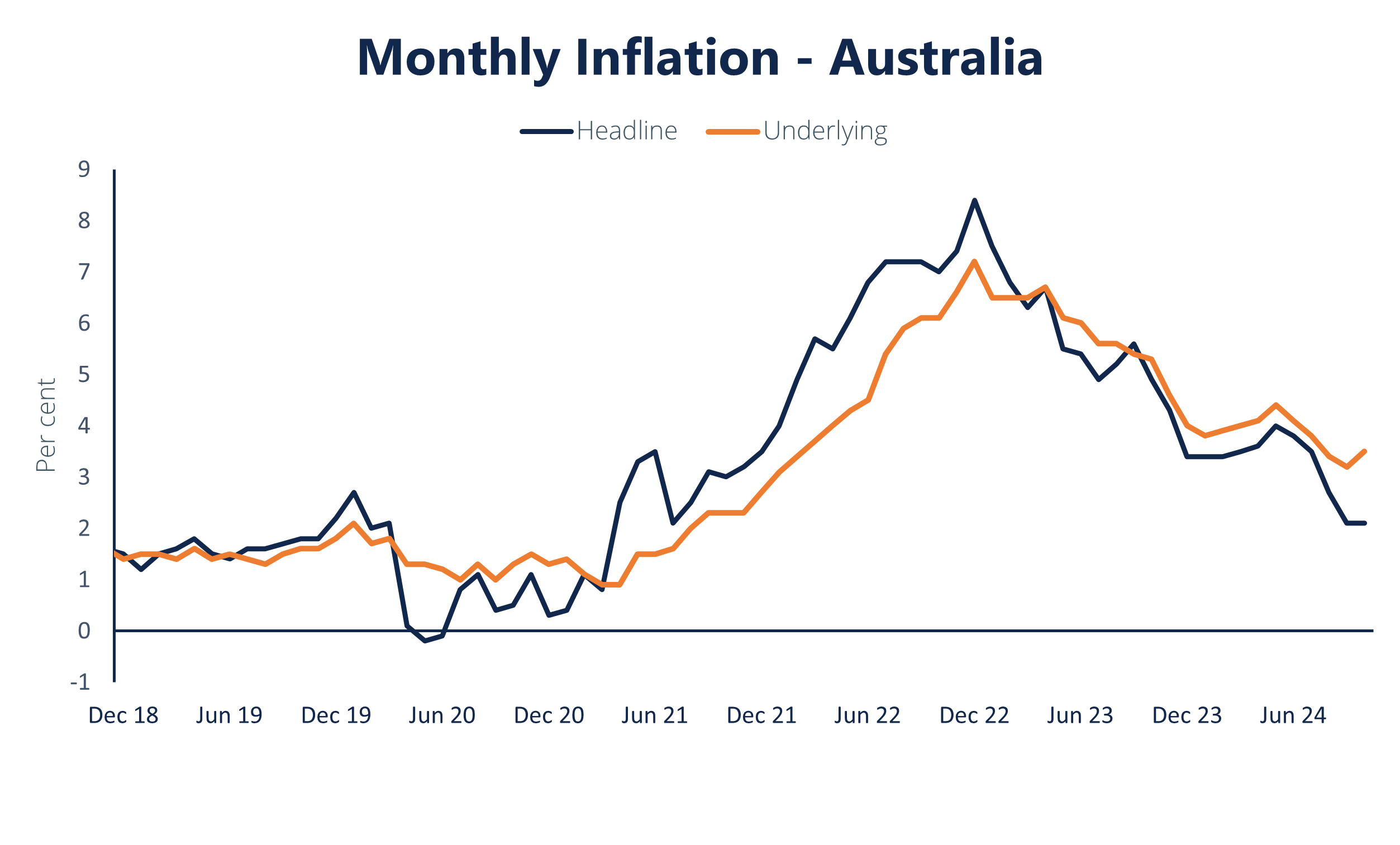

Inflation unchanged but cooler than expected

Monthly headline inflation came in slightly under expectations this week, with prices rising 2.1% in Australia over the year to October, unchanged from last month. Trimmed mean (or underlying) inflation ticked up to 3.5%, however this was in line with expectations.

Electricity prices were again a major drag (down 12.3% month on month), as the current electricity subsidies being rolled out nationwide continue to impact. Goods inflation has also continued to soften ahead of Black Friday sales as the discounting cycle around this event begins, while rental prices also fell over the month (-0.3% month on month), reflecting the 10% increase to the Federal Government’s Commonwealth Rent Assistance.

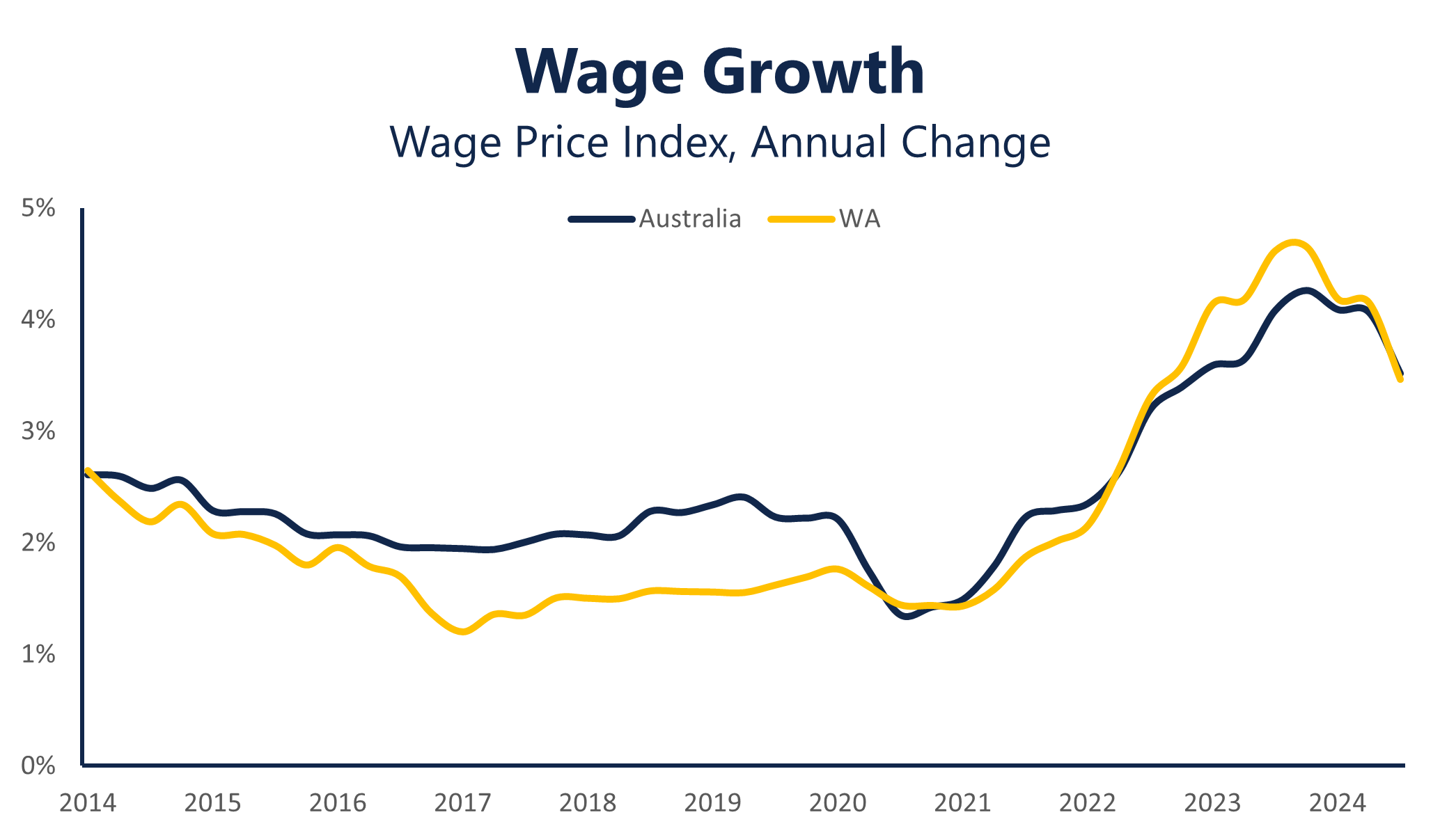

WA wage growth eases further

Recent wages data revealed that wage growth in WA has continued to moderate over the September quarter. WA’s Wage Price Index (WPI) rose 3.5% over the year to September, down from the 4.2% growth recorded in June.

This is on the back of a lower increase to the minimum wage than last year, which came into effect on July 1 and has helped moderate the pace of growth. Indeed, wages are now growing at their weakest pace since September 2022, having peaked in December 2023.

CCIWA’s Economic reports are available exclusively to CCIWA Complete, Advantage and Corporate Members. For more see CCIWA’s Economic Insight page.