As businesses enter a new year and the government subsidies introduced in response to COVID-19 taper off, it is crucial to stay on top of your cash flow.

As Tony Monisse - Director of Chartered Accountant and Advisory firm Brentnalls WA - explains, having a profitable business is paramount to cash flow.

If you can speed up the time your business goes through the working capital cycle, the better it will be for your profits.

Here, we explain the components of the cycle and some some factors to help run a successful business.

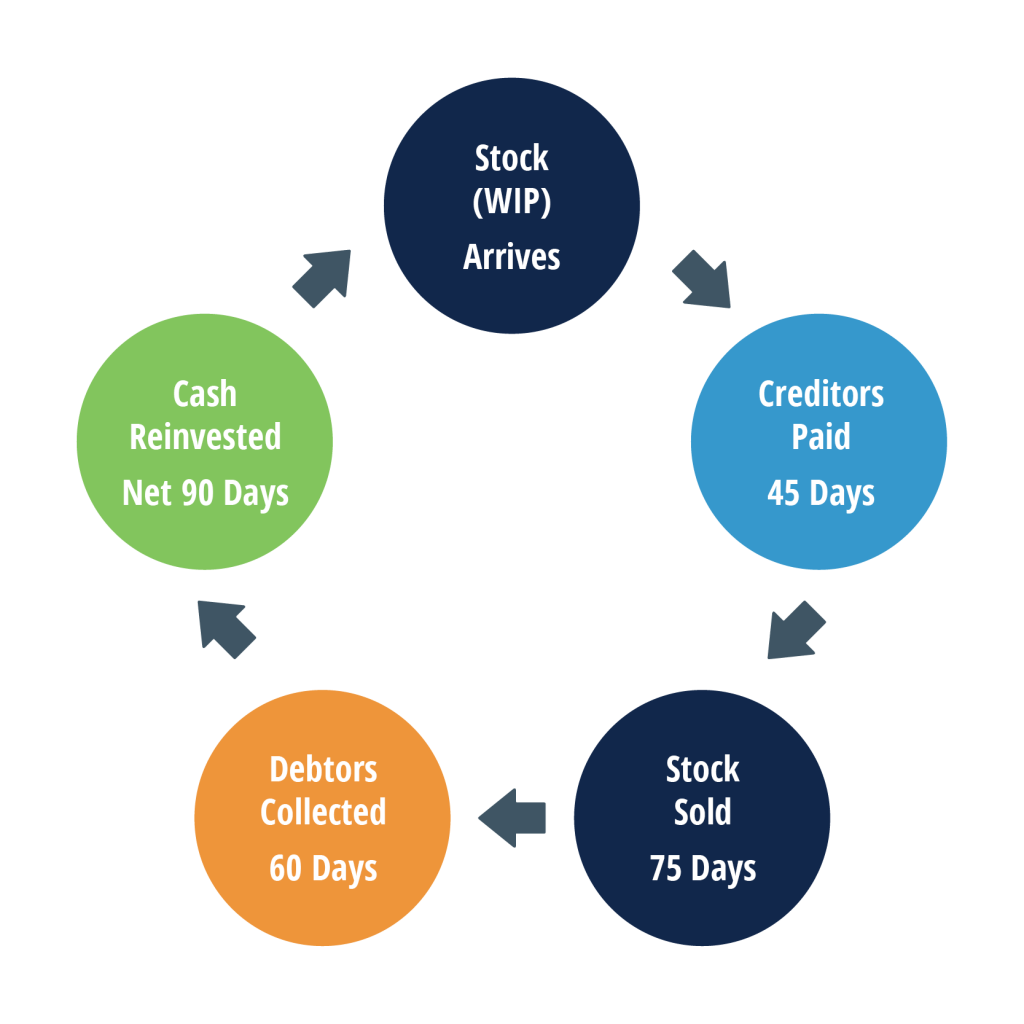

The working capital cycle

Monisse says the faster a business can work through the cycle, the quicker they can make a profit.

A company's stock, or work-in-progress, often needs to be paid for by a business before it is sold.

If a business needs to pay its creditors 45 days after its stock arrives, but the stock is not sold until 75 days after it arrives, this leaves a 30 day period where businesses could be in debt.

If it then takes another 60 days for the debt to be collected, this means the cash will be invested for 90 days after it arrives.

"The shorter you can make the cycle, the quicker you can get your money back and reinvest in new stock to make more sales, so ideally you want to reduce the cycle," Monisse says.

He explains that often businesses can make money without realising profit could be absorbed as working capital.

"Businesses may need to spend on capital expenditure, need to pay off debt or equity, or pay tax," he said.

"By the time that all comes out they might only end up with a small amount of cash."

He says it is also important for businesses to consider each component of the working capital cycle, in determining their profits.

Breaking it down

The concept of working capital can be broken down into several key parts:

According to Monisse, businesses should maintain a constant communication with their debtors.

As he explains, some debtors may be struggling – particularly as the world responds to a pandemic.

“In that case it is also important to put in place payment plans, and just negotiate how best to collect those amounts that are outstanding,” he says.

“The other thing I'd encourage around debtors is for businesses to invoice frequently - the more frequently you invoice, the quicker you're going to collect that money.”

It is important for businesses to assess and re-assess their inventory, particularly when supply chain disruptions are occurring.

Monisse adds that businesses should consider what stock is slow moving and look at opportunities to move that inventory, even if you have to discount.

Much like the relationship with your debtors, fostering communication with your creditors is vital to running a successful business.

“That could include the tax office, it could include payments to key suppliers, and looking at arrangements to pay those suppliers that are acceptable to them, but I think the most important thing with dealing with your suppliers is to keep them informed,” Monisse says.

Monisse adds that business owners need to be conscious of how much they need to take out of the business, even looking at their own personal budgets.

He says there are often opportunities to review how much you need to draw, whether that money could be drawn out in a different way – as wages, dividends or any other tax effective ways.

"If businesses can stay on top of these drivers of sales, profit and cashflow, they will be able to successfully navigate through this period as subsidies taper off and sustainably grow their business into the future."

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvina.

Looking ahead

Monisse says understanding the ways in which these drivers have impacted your business in the past is crucial to planning for a business’ future.

“Once we understand those drivers of sales, profit and cash flow, then the business can start forecasting forward,” Monisse explains.

“It’s very important to look at historical performance of those drivers to forecast what the future performance of the business is likely to be, and also to forecast what the position of the business may look like under different scenarios.

“I think that sort of scenario analysis, the ability to look at the different scenarios and understand, well, what if sales increased or came back by 10 per cent, what impact does that have on our profit and on our cash flow?”