Perth’s inflation rate has eased slightly over the March quarter, according to data released today. CCIWA Senior Economist Sam Collins explains.

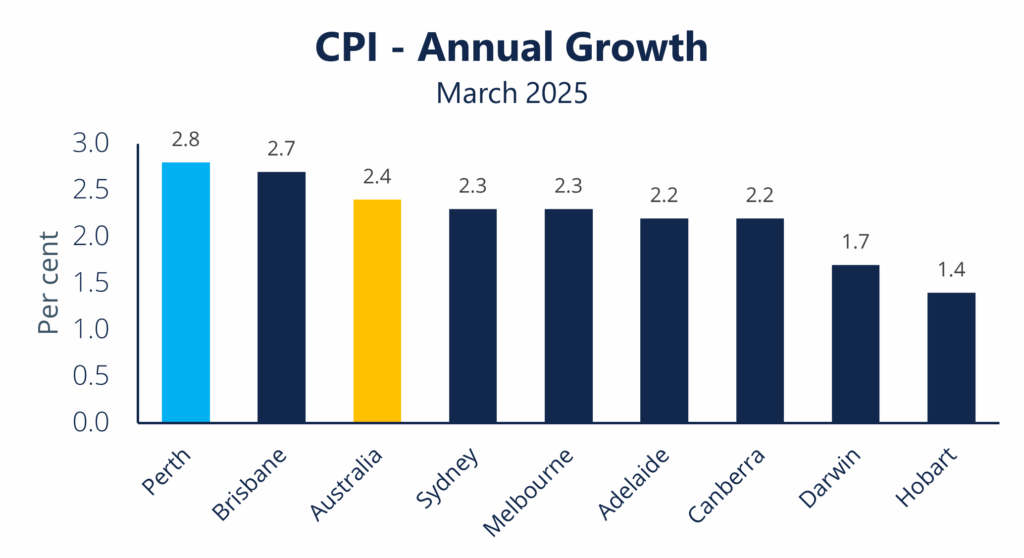

The latest Consumer Price Index data released this morning showed prices in Perth rose 0.5% over the March 2025 quarter. This takes the annual rate of headline inflation to 2.8%, down slightly from the 2.9% recorded in December 2024. While the quarterly increase was the lowest in the country, the annual rate of inflation is now the highest of all states.

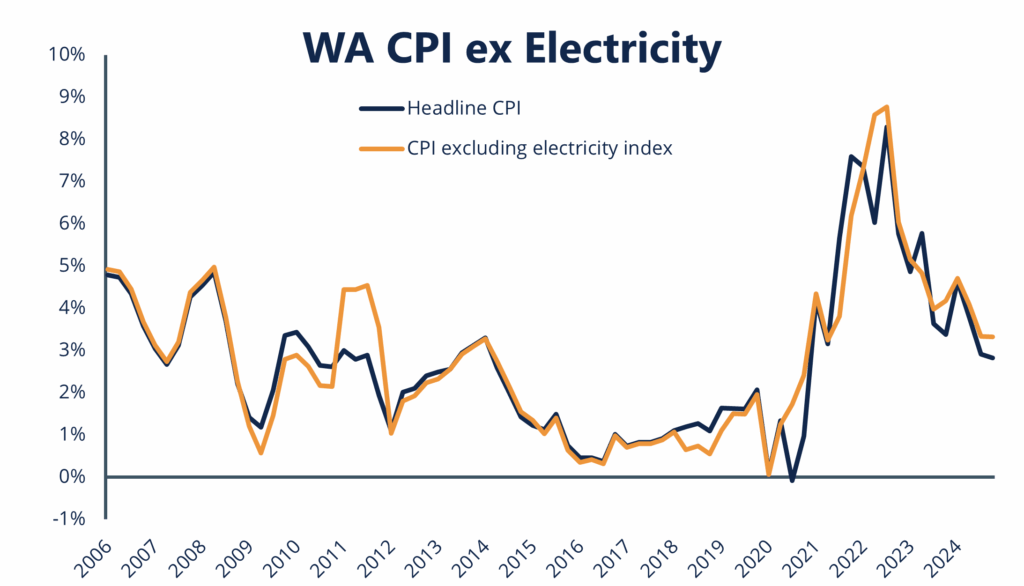

Excluding the electricity index, given the large impact electricity subsidies provided by both the State and Federal Governments have on headline CPI data, Perth’s annual rate of inflation was 3.3% – the same as last quarter.

Some of the main contributors to the increase this quarter were education (+5.6% QoQ) medical products (+4.7%), fruit and vegetables (+3.4%) and automotive fuel (+3.4%). On the flipside, the main detractors were electricity (-27.6% QoQ) as a result of subsidies, transport fares (-11.1%) as a result of free public transport over the start of the year, and international travel (-7.1%).

Services inflation continues to remain a key watch point, rising 4.0% annually. This is more than double the pace of goods inflation, which rose just 1.9% over the year.

Nationally, prices rose 0.9% over the quarter and 2.4% over the year – unchanged from last quarter but slightly above expectations of 2.3%. Importantly, trimmed mean inflation (which is the RBA’s preferred inflation measure) is now 2.9%, which is the first time it has been inside the RBA’s target band since December 2021.

What this means for WA businesses

Today’s data shows there should be enough progress made for the RBA to cut the cash rate at their next meeting on May 20.

While interest rates will still remain restrictive, this should provide some further relief to WA businesses that are making loan repayments or looking to increase borrowings.

CCIWA’s Economic reports are available exclusively to CCIWA Complete, Advantage and Corporate Members. For more, see CCIWA’s Economic Insight page.