Economic and industrial relations policies are contributing to the increasing cost of doing business and hindering growth in WA.

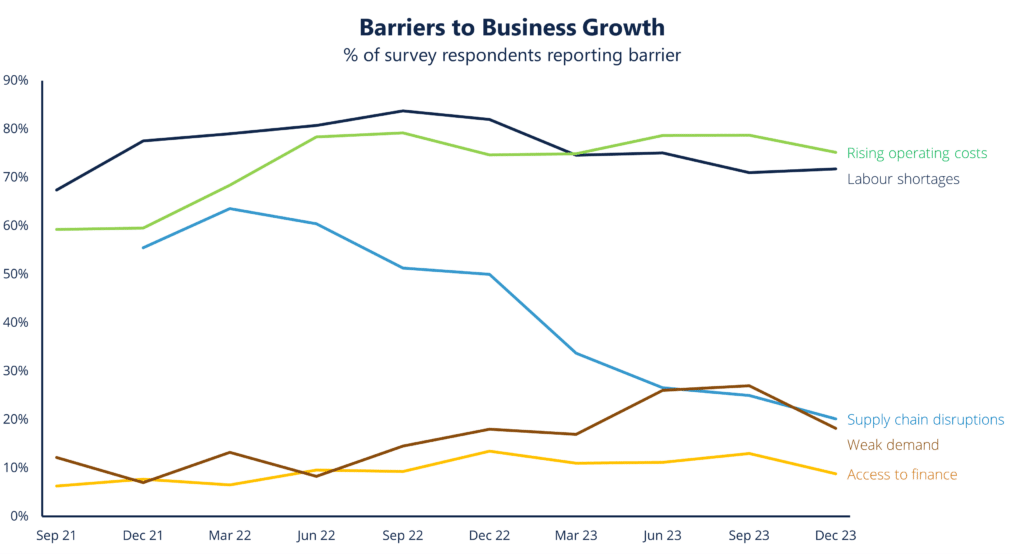

CCIWA’s quarterly Business Confidence report finds three in four (75%) businesses see the rising operating costs as the biggest growth barrier for 2024.

Labour shortages are also a prominent challenge for businesses, with seven in 10 (69%) struggling to secure workers with specific skills.

Burdened by unfair payroll tax

CCIWA Chief Economist Aaron Morey says the biggest cost faced by businesses is their wages bill, which is compounded by WA’s unfair payroll tax system.

“When combined with skyrocketing costs across the economy, WA’s excessive payroll tax is hitting many small and family businesses in the hip pocket,” he says.

“We know that WA pays the highest payroll tax in the country, despite the fact that our State’s finances are the best in the nation. It’s unfair and it needs to change.

“There are around 92,000 businesses in WA that employ people and of those, just over a quarter pay payroll tax.

“There’s not much the State Government can do to tackle inflation driving up costs, but they can offer some relief to businesses by fixing the tax on jobs and success.”

IR reforms a ‘Closing Christmas’ Bill

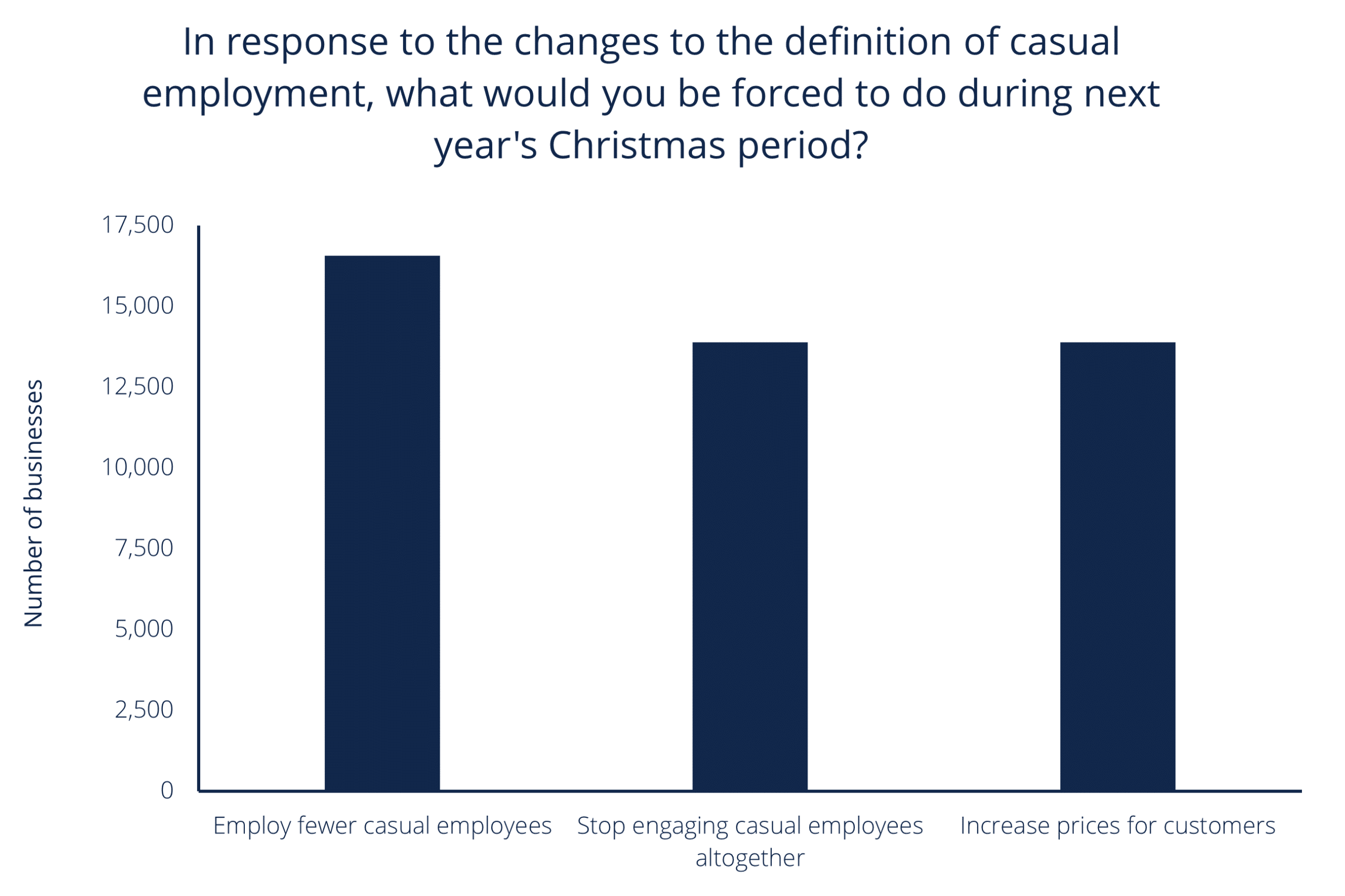

The survey of 816 businesses, asked what implications the Federal Government’s Closing Loopholes Bill would have on casual employment for Christmas 2024. The survey was conducted in November, after the Government announced changes to the Bill.

CCIWA’s report shows 48% would have to change their staffing intentions or prices for next year’s Christmas.

Furthermore, 18% expected to hire fewer staff, equating to 16,000 businesses slashing casual roles, and 15% or about 13,900 businesses reported they would have to abandon hiring casuals, with the same proportion saying they would increase prices as a result.

While amendments to the Bill saw the removal of significant fines for businesses that misclassified a casual worker – welcomed by CCIWA – many businesses that hire casuals remain deeply concerned about provisions that create a pathway to permanent employment after six months.

Chris Rodwell, CCIWA’s CEO says the report shows businesses’ concerns about the Bill remain high, despite concessions made by the Federal Government.

“The past few months have seen an inadequate process of tinkering at the edges of this deeply flawed Bill, and these results show that’s done little to calm the anxieties of WA businesses that hire casuals,” he says.

“We were pleased to see the amendments to the Bill which included removing the huge financial penalties proposed for employers who accidentally misclassify a casual worker.

“But it’s clear that this Bill, which completely changes the relationship between the casual worker and their employer, poses huge risks for businesses and many will simply change their hiring behaviour as a result.”

Casual workers to take major hit

“Christmas is a great time of year for casual workers, many of whom are university students or working parents, because they have the capacity to take on more hours,” he says.

“Employers will see casuals as a liability, knowing they could be forced to convert them to permanent after just six months if they have a regular pattern of work, regardless of any legitimate business reasons they may have to keep the worker as a casual.

“This would adversely impact the many seasonal businesses across WA that need a surge of casual staff over the warmer months.”

Rodwell says many workers rely on the flexibility and higher wages offered by casual roles to combat the cost-of-living crisis.

Confidence tips up

Despite the challenges, WA businesses are slightly more optimistic about economic conditions in the short (three months) and long-term (12 months) than they were in the previous quarter.

In the short-term, three in 10 (32%) expect conditions to improve, with 40% expecting no change and 28% anticipating worse conditions.

The long-term outlook is more pessimistic, with one in five (21%) businesses predicting improved conditions, 42% expecting no change and 37% think conditions will soften.

However, compared to the December 2022 report, this year’s long-term outlook is more optimistic as last year 15% of businesses were expecting better conditions for the year ahead. The short-term outlook is similar to last year’s, when 33% were predicting improved conditions.

CCIWA’s Economic reports, including Outlook, are available exclusively to CCIWA Advantage and Corporate Members. For more see CCIWA’s Economic Insight page.