New critical minerals initiatives announced by the Australian and United States governments signal a coordinated push on global investment and supply chain resilience, with Western Australia firmly in the spotlight.

The refreshed Australian Critical Minerals Prospectus, unveiled in Washington last week by Federal Resources Minister Madeleine King, helped sharpen the nation’s pitch to global investors and strategic partners.

The launch coincided with the US Government’s 2026 Critical Minerals Ministerial, which brought together more than 50 countries, including Australia, to discuss new approaches to securing critical minerals supply chains. In parallel, the Trump administration held bilateral discussions with individual countries to pursue critical minerals frameworks similar to the agreement Australia signed in October 2025.

What’s changed in Australia’s Critical Minerals Prospectus?

Australia’s Critical Minerals Prospectus has been updated to attract international investment, create jobs and build new supply chains with partner nations.

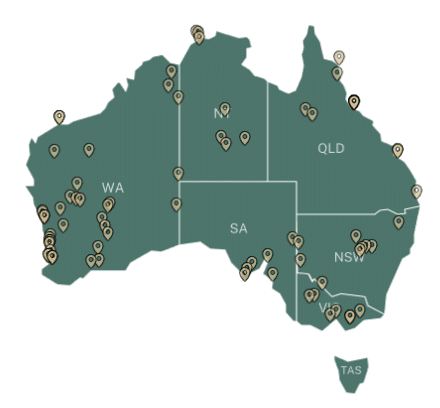

The prospectus profiles 78 projects across 60 companies, including 38 in WA, all described as “ready for investment”.

It highlights projects with midstream capabilities, showing an investable pipeline that reflects mineral processing opportunities in Australia – a clear move beyond mineral extraction.

“Australia has a responsibility to lead on the production of critical minerals and rare earths globally,” Minister King said at the prospectus launch on February 4.

“Australia has the deposits and the know-how to develop critical minerals projects reliably, sustainably and at scale. We have the expertise and world-leading labour and environmental standards.”

New phase for allied critical minerals supply

The US-hosted ministerial focused on reducing vulnerabilities from concentrated processing capacity and non-market practices.

Speaking at the meeting on February 4, US Vice President JD Vance said the nation would pursue new mechanisms to support allied supply chains, including establishing “reference prices for critical minerals at each stage of production, pricing that reflects real-world, fair-market value”.

Key plans of this trade agenda include:

- Project Vault – a strategic critical minerals reserve backed by up to US$10 billion in financing from the Export-Import Bank of the US, designed to store essential materials and shield manufacturers from supply shocks.

- Forum on Resource Geostrategic Engagement (FORGE) – intended to coordinate policy and investment decisions across a large group of partner countries.

What this means for WA businesses

For WA businesses, CCIWA Head of International Trade Services Michael Carter said the impact and opportunities of these initiatives extended beyond mining.

“The opportunity is not just in resource ownership, but in proving projects can be financed, built and integrated into allied supply chains – particularly in processing, infrastructure, energy and professional services,” he said.

Carter said the emphasis on midstream processing increased opportunities for WA-based engineering, construction, logistics and energy providers, as well as businesses supporting compliance, ESG and project development.

“International partners are looking for certainty on project timelines and execution. WA businesses that can demonstrate capability across the value chain are well placed as governments and investors look to de-risk supply,” he said.

Through the WA Investments platform, CCIWA is supporting WA businesses by improving visibility of investment-ready projects and facilitating connections with local and global investors.

CCIWA’s International Trade Services team helps businesses reduce the time, cost and risk of going global. Contact the team for a free consultation on 08 9365 7620 or via [email protected].