The final payment of an employee can comprise of contractual, industrial award and legislative entitlements.

These entitlements may include:

- wages.

- notice of termination.

- redundancy pay.

- leave entitlements.

- contractual benefits.

An employee should be paid all entitlements within the first pay period following the effective date of termination, including any wages owing for time worked, unless otherwise required by an industrial instrument.

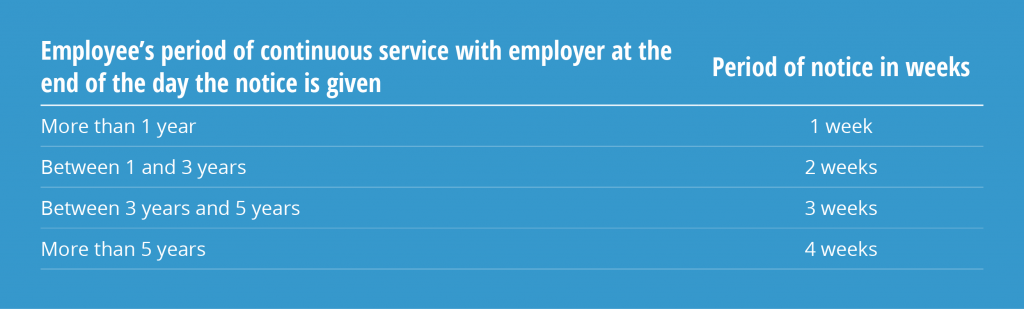

An employee terminated for any reason, other than serious misconduct, is entitled to a period of notice based on their years of service. The legislated minimum notice period based on completed years of service is contained below:

Employees over 45 years of age with two or more years of completed service are entitled to an additional week of notice on top of the above legislated minimums.

An industrial instrument such as an enterprise agreement or award, and/or contract of employment, may outline the notice required to be given by either party on termination of employment. Employers are encouraged to refer to their applicable industrial instrument and/or contract of employment for notice of termination requirements, as these may be more beneficial to an employee.

Where the employer has provided notice of termination, the employer may elect to pay a lump sum payment in lieu of allowing the employee to work out the notice period. Where the employee provides notice of resignation and the employer wishes to pay the employee in lieu of their notice, employers should ensure that there is provision to do so under the contract of employment. The employee will need to be paid for the notice period in full even if they have already worked out some of that notice.

On the termination of employment, an employee is entitled to all accrued annual leave and the entitlement will apply regardless of the manner of termination or resignation. Annual leave does not accrue on payments made in lieu of notice. It is also important to note that payment will be required for annual leave loading on any unused annual leave paid on termination.

Long service leave

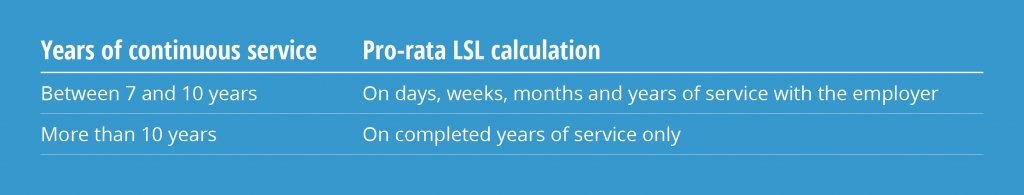

The Long Service Leave Act (WA) 1958 provides that an employee is entitled to payment for pro-rata long service leave (LSL) on termination following 7 years of continuous service.

Pro-rata LSL is calculated in accordance with the following table:

An employee who is terminated for serious misconduct forfeits their entitlement to pro-rata LSL.

Personal/carer’s leave

Personal leave rarely forms part of a termination payment, however an industrial instrument may contain a provision for the payment of personal leave entitlements on termination.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus.

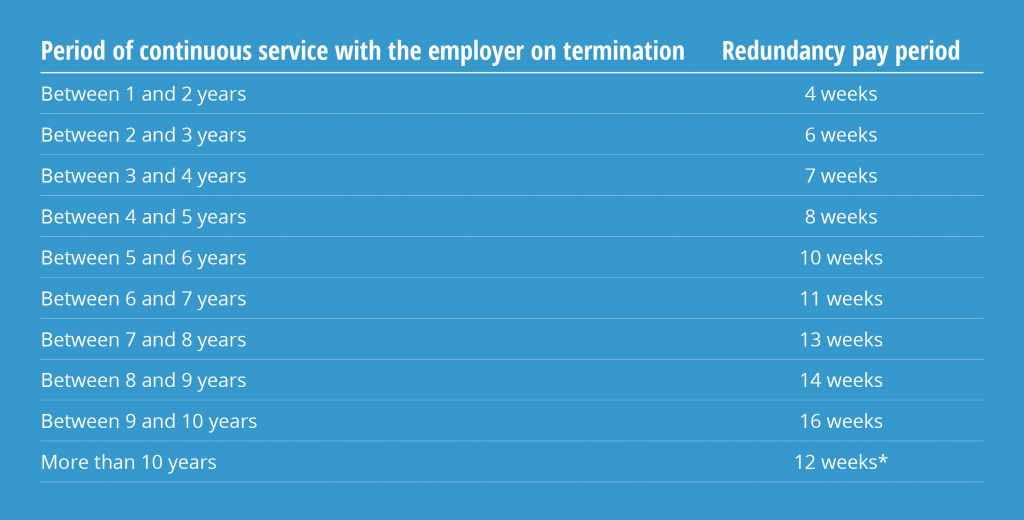

Small business

A general exemption applies for small businesses, alleviating the requirement to make payment for termination by reason of redundancy. A small business is defined as an employer who engages fewer than 15 employees.

Note: Industry specific redundancy schemes, Notional Agreements Preserving State Awards (NAPSAs) and other industrial instruments or contractual entitlements may influence the amount or application of redundancy payments for small businesses. For further information contact the Employee Relations Advice Centre on (08) 9365 7660 or [email protected].

Ability to withhold

An award or agreement may permit an employer to withhold a sum from an employee’s final payment. If a resigning employee fails to comply with the notice requirements outlined in their award or agreement, the employer may withhold from wages due to the employee on termination under the relevant instrument, an amount not exceeding the amount the employee would have been paid under the industrial instrument in respect of the period of notice required, less any period of notice actually provided by the employee.. It is important that employers refer to their industrial instrument on the ability to withhold/deduct wages.

If an award or agreement permits an employer to withhold a sum as outlined above, the employer must only deduct funds from outstanding wages, not from any leave entitlements (such as accrued annual leave or leave loading).

Serious misconduct

Serious misconduct is wilful or deliberate behaviour that demonstrates that an employee no longer wishes to be bound by the employment relationship. An employee who is terminated on the grounds of serious misconduct may forgo a number of entitlements within a final payment. These may include but are not limited to;

- pro rata LSL

- notice of termination and payment in lieu of notice of termination

- industry specific redundancy schemes.

An employee will retain their entitlement to their accrued annual leave and wages for any time worked prior to the termination when terminated on the grounds of serious misconduct.

Tax and superannuation

CCIWA does not provide advice on tax or superannuation related matters. For queries relating to how tax is payable on part or all of the termination payments please contact the Australian Tax Office (ATO) business hotline on 13 72 26. For queries regarding super payments on termination please contact the ATO superannuation hotline on 13 10 20.

Related information

The Employee Relations Advice Centre provides corresponding information sheets to provide further detail in areas relating to final payments including:

- Redundancy (State or National System)

- Superannuation Guarantee

- Abandonment of Employment

- Final payments for deceased employees

- Summary dismissal

For further information please contact the Employment Relations Advice Centre on (08) 9365 7660 or email [email protected].