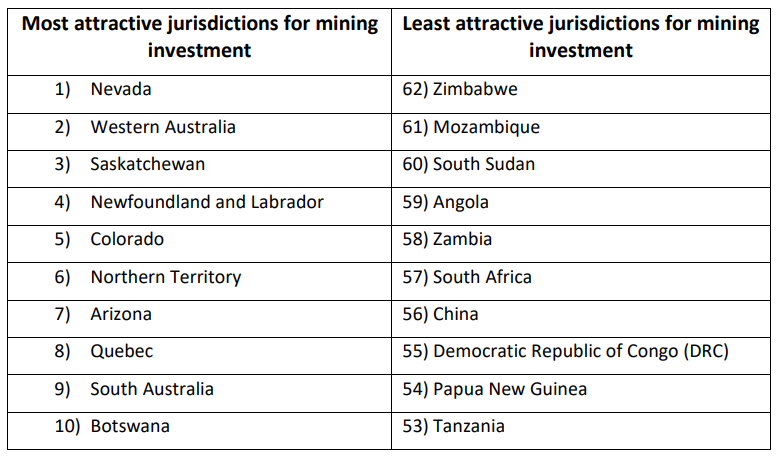

Western Australia has lost its reign as the most attractive mining region globally for investment, according to the Fraser Institute Annual Survey of Mining Companies 2022.

The State is superseded by Nevada which scored 92.17 in the Investment Attractiveness Index, compared to WA with 90.21.

Although WA dropped to second place, its score for 2022 is higher than its previous score in 2021 – 88.82 – which saw it top the list last year.

Although WA dropped to second place, its score for 2022 is higher than its previous score in 2021 – 88.82 – which saw it top the list last year.

The Investment Attractiveness Index is derived by surveying companies operating across 62 jurisdictions (every continent except Antarctica) in the global mining industry.

“A sound regulatory regime coupled with competitive taxes make a jurisdiction attractive to investors,” says report co-author and director of the Fraser Institute’s Centre for Natural Resource Studies Elmira Aliakbari.

“Policymakers across the globe should understand that mineral deposits alone are not enough to attract investment.”

WA and its competitors

Australia has retained its leading mining jurisdiction in the world crown, with the Northern Territory ranking sixth and South Australia ninth.

Canada and the United States both had multiple high-scoring regions – including Saskatchewan (third), Newfoundland & Labrador (fourth), Colorado (fifth), Arizona (seventh) and Quebec (eighth).

Mineral Council of Australia chief executive officer Tania Constable says despite the positive results, Australia still needs to ensure it remains competitive.

“There are signs that investors are being deterred by poor government processes and policies. Australia’s geological potential will not be able to continue to counterbalance this trend to higher royalties and policy processes that delay approvals and investment decisions,” Constable says.

“Australia’s vulnerability to competition from resource-rich economies will only grow as they seek to seize the opportunity to supply the minerals and metals needed to achieve global net zero emissions.

“To attract a significant proportion of this investment that will create tens of thousands of new regional jobs, business growth and investment should be placed at the centre of the government’s policymaking.”

Policy impacts investment attractiveness

WA’s drop in investment attractiveness is largely due to policy factors, as its Policy Perception Index (PPI) fell almost six points. The State’s ranking also declined from fourth (of 84) in 2021 to 10th (of 62) in 2022.

Respondents expressed increased concern over WA’s taxation regime, uncertainty regarding environmental regulations, and regulatory duplication and inconsistencies.

“Current policy settings are putting at risk investment in mining,” Constable says.

“Workplace relations, tax, environment, climate change and energy policies that impose unexpected costs on the mining industry threaten the capital investment that underpins its contribution to the economy and the global efforts to decarbonise.

“Australia needs more investment along the entire mining value chain to boost the economy’s performance and play its part in the goal of net zero emissions by 2050.”

If you are looking for support or advice in business, investment or trade, contact our experienced International Trade and Investment Centre team at [email protected].