Ambitious business owners and entrepreneurs always have one eye on the future. Australian Business Growth Fund explains why securing the right capital is an important step in making your vision a reality.

Ambitious business owners and entrepreneurs always have one eye on the future. But whether you want to strengthen your team, ramp up sales and marketing, build out your capabilities or expand your operations, securing the right capital is an important step in making your vision a reality.

Growth funding is a type of equity funding designed to help businesses invest in growth opportunities that will enable them to scale. This guide provides an overview of growth capital, explains how it differs from other types of equity funding and details how to decide whether it is right for your business.

So, what is growth capital?

Growth capital is designed to support businesses with a demonstrated track record of commercial success in furthering their growth aspirations.

Like other forms of equity-based funding, investors provide growth capital in exchange for an equity stake in the business.

Some investors are providers of minority equity investment – this means they make investments in exchange for less than a 50% equity stake in a business. A minority investment with the right funding partner enables the existing shareholders to retain control and steer the business in the direction they want.

How does growth capital compare to other types of funding?

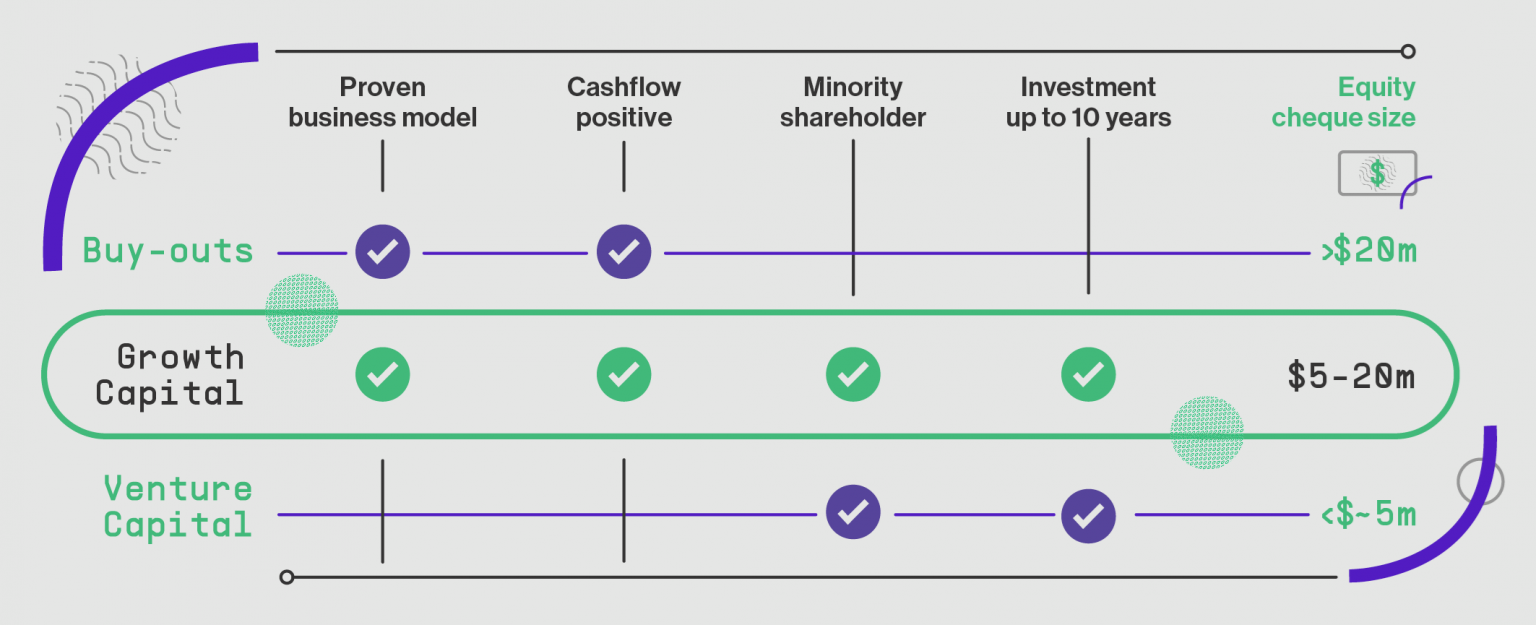

True growth capital fills the gap between other forms of equity-based funding, such as venture capital (VC) and buyout funds.

The VC market has been growing steadily in Australia over the last decade — with companies such as Canva and Airwallex shooting to ‘unicorn’ status in just a few years. Both VC and growth capital focus on backing high-potential entrepreneurs and businesses, but there are a few key differences.

First, growth capital is typically provided to established companies with a proven business model. From a profitability standpoint, the business would have often hit breakeven or already have positive operating cashflow and can demonstrate a strong commercial ability to scale and grow profitably in the future.

Investments are always risky, but in growth capital investments, the risk is typically centered on the management team’s ability to execute a clear strategy and navigate the challenges related to scaling their operations into new product categories or markets.

By comparison, companies that are more suited to VC funding tend to be earlier in their journey, such as startups. VC firms and angel investors may be the first to back the company aside from the founders themselves — and these investors are attracted to the business’s ‘hockey stick’ growth potential.

With that potential, however, comes significantly more risk, as the businesses may be pre-revenue and may not yet have a commercially viable version of their product. Instead of focusing on profitability, early-stage investors back investee companies in raising additional rounds of capital — often supporting a negative cashflow in the business as it continues to grow and scale.

As with growth capital investment, VC investors are typically minority investors, which incentivises the founders they’re supporting to stay with the business as it grows.

VC investments tend to be smaller than growth capital investments (often less than $5 million for early rounds compared to upwards of $10-$20m with growth capital), and due to the early nature of the investment there is an expectation that a longer investment horizon is required until an ‘exit’ can be made (between five to 10+ years).

Business funding may also come in the form of a buyout from a larger private or listed company (often called a 'strategic buyer') or from a private equity fund. This capital is quite distinct from growth funding in that the capital is typically used to buy out existing shareholders – that is, existing shares are sold from an existing shareholder to a new shareholder and no new shares are issued in the business.

This is different to growth equity where new, additional shares are issued to the new investors and the capital raised typically remains within the business itself. Buyout funds typically seek out larger investment amounts (anywhere from the tens of millions to more than $1 billion for larger funds), with an expectation of a shorter investment horizon (between three to five years).

Another characteristic of buyout funding is that investors in this category are typically looking for a controlling stake in their investee companies – which may not align with the goals of business owners who are seeking to retain control of their company. With minority investment growth capital, founders stay in control and can leverage the incoming capital to maximise the value of their business before they decide to sell down completely.

It's more than money

Few business owners or entrepreneurs would claim they have all the connections, support, and advice they need to succeed. That’s why, regardless of the specific funding source, there is inherent value in securing capital for your business that provides more than just a cheque.

With an investor that provides ‘patient’ growth capital and is committed to supporting the long-term future of your business, such as over a 5 to 10-year period, you have a partner that is signaling they will continue to support the business through short-term market upheaval. They become a collaborative, long-term shareholder who is strongly aligned to the goals and values of your business.

That is why active minority investors often provide significant added value to their investee companies. In some cases, support can include participating on the board, facilitating introductions to potential customers and talent networks, and assisting business leaders in navigating strategic roadblocks, succession planning and operational expertise.

It’s key for business owners to be clear about the type of support an investor is committed to providing and how it can work to support the overall business strategy.

Is your business ready for growth capital?

For certain businesses, growth capital is the ideal type of funding to take them to the next level. So how do you know if it’s right for your business? A few indicators that a business is suitable for growth capital include:

- A stable financial position — Businesses that have had a consistent cashflow and are at break-even or profitable are good candidates for growth capital investment.

- A track record of growth — If you can demonstrate consistent growth since inception of your business, growth capital investors are likely to identify you as a high-potential company.

- A unique value proposition — Investors look for businesses that can demonstrate a clear competitive advantage over their competitors or businesses with solutions addressing clear gaps in their chosen markets.

- A solid plan for future growth — Equally important for businesses looking to secure growth capital is a coherent roadmap for growth, backed up by robust financial forecasts.

Timing is also an important factor. The best time to reach out for investment is well before it is strictly ‘necessary’ to raise funds. Growth capital investors don’t offer ‘rescue capital’ and are less likely to invest in a business that is experiencing cash flow distress.

Business owners should be proactively thinking about their capital needs, particularly while you have the time and headspace to make considered decisions in the best interests of your business.

The Australian Business Growth Fund™ (ABGF) is an active provider of patient, minority growth capital for Australian businesses with over $2 million in revenue and a proven business model.