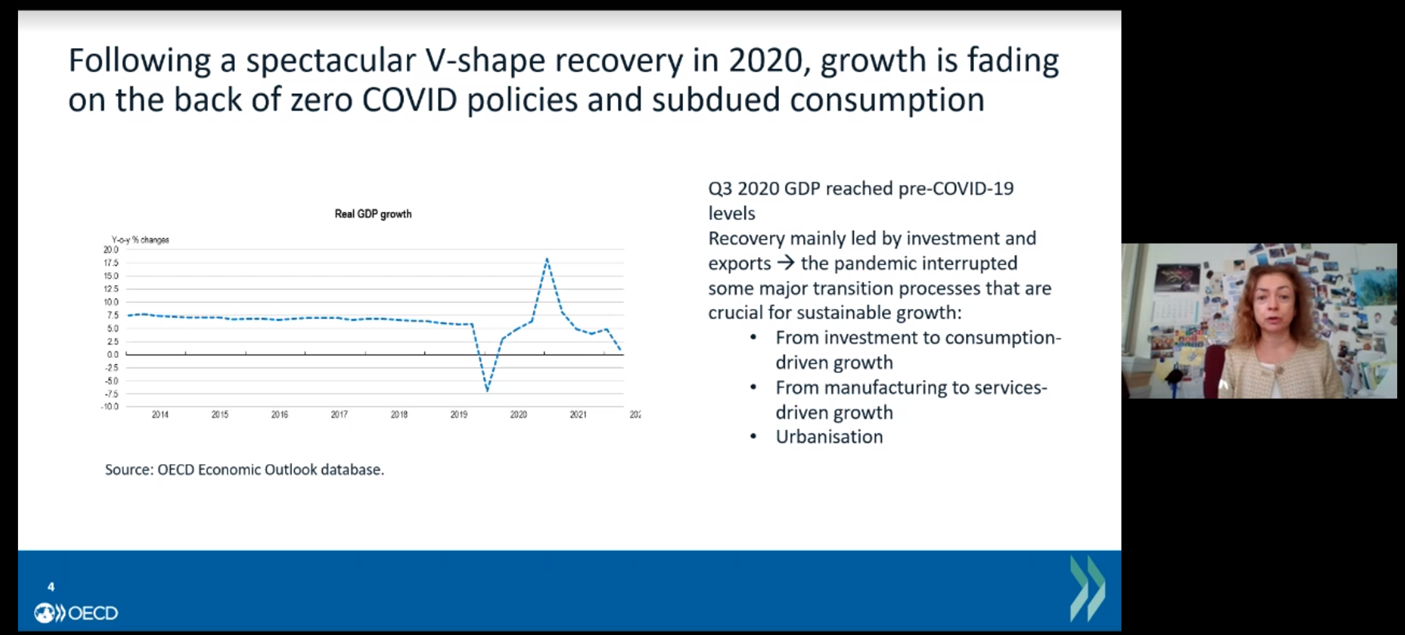

China’s post-COVID recovery has stalled with manufacturing and infrastructure investment weakening amid a backdrop of challenges around demography, supply chains and rising debt, according to the Organisation for Economic Cooperation and Development’s Margit Molnar.

Speaking at a joint CCIWA-OECD webinar on the Future of China’s Economy, Molnar, who heads the OECD’s China Desk in Paris, said China’s recovery — mainly led by investment and exports — was the fastest among the world’s major economies, but it was not sustainable.

“Now the situation is a little bit different,” she said.

“China has always been quite interesting and always surprises us with its changes, but this is a time when China’s growth engines are struggling.”

Molnar said the pandemic interrupted major transition processes that are crucial for sustainable growth, including investment to consumption-driven growth; manufacturing to services-driven growth; and urbanisation.

“They need to restart to move back to the slowly growing trajectory,” she said.

Manufacturing, infrastructure investment stalled

Molnar said manufacturing and infrastructure investment had recently both stalled due to supply-side restrictions related to lockdowns and China’s COVID-zero policy, and chip shortages.

As well, private investment share has been declining by 7-9 percentage points in the past decade due to a lack of opportunity to participate in infrastructure projects, regulatory changes governing tenders and a decline in real estate investment.

“Now there will be a slight reshaping of the structure of investment, so instead of real estate investment, probably infrastructure investment will be the largest component of investment,” she said.

“Now there will be a slight reshaping of the structure of investment, so instead of real estate investment, probably infrastructure investment will be the largest component of investment,” she said.

However, she said the biggest opportunity for businesses over the next few years was China’s productivity development and prospects, noting that “there’s very still a huge room for productivity catch up” compared to the US.

She said numerous policies, which if enacted, would lead to productivity catch-up, including plans to establish a single domestic market.

In other observations, Molnar said:

- Retail sales are slackening in China amid an increased appetite for saving, and lockdown-related supply-side constraints;

- Export growth has tapered after China initially catered to massive global demand for products such as face masks and computer components;

- Imports are weaker, related to increased components and capital growth in China;

- Credit growth is stable while shadow banking is being reined in; and

- CPI is rising but still moderate;

Demographic challenges

She said China’s working-age population has been falling for a decade, with more people aged over 65 than previously expected, and fewer working-age people than expected.

“The prospects are event bleaker than expected,” she said.

Molnar said State-owned enterprise debt was the fastest-growing risk for China, making up most of the country’s corporate debt at 150-160 per cent.

However, she said investment will likely remain an important driver of growth in China.

She said if a Chinese MRNA vaccine or medicine made it to market, it would be a game-changer for loosening COVID restrictions and lifting output.