Major changes to industrial relations (IR) laws around casual employment took effect this year, having wide-ranging impacts on employers.

As CCIWA’s Workplace Relations Director Ryan Martin explains, the changes were initially part of a broader series of IR reforms that were watered down in Parliament.

New rules around converting employees from casual to permanent employment may make taking on apprentices and trainees a more attractive option for some businesses.

CCIWA’s experts outlined the impact of the casual changes at a recent Apprenticeship Support Australia (ASA) webinar.

Casual changes - steps to take

The changes to casual employment include provisions for employers to offer their casual workers the opportunity to convert to permanent work.

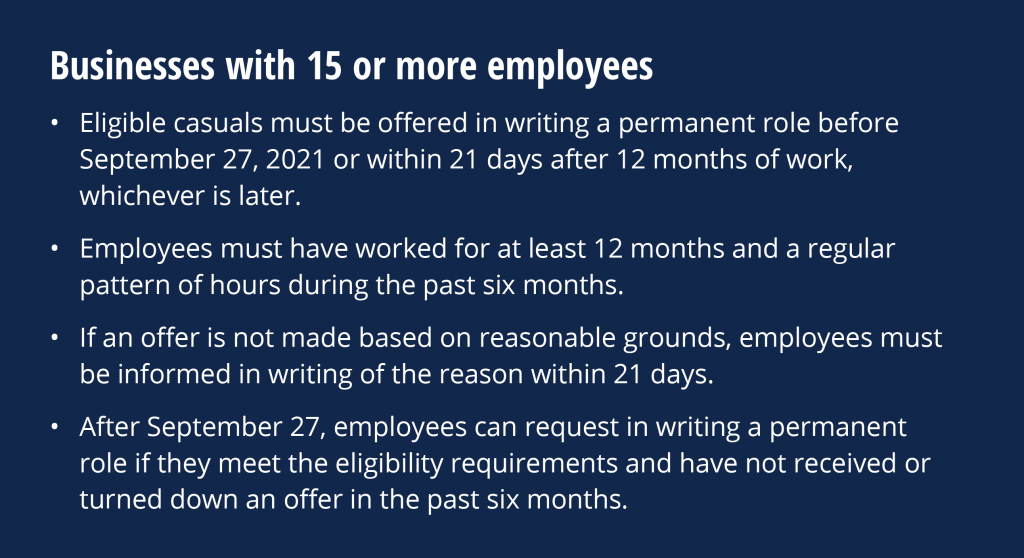

Under the revised Fair Work (FW) Act, employers are required to offer part-time or full-time roles to casuals after 12 months, if they have worked a regular pattern of hours for at least six months of that period.

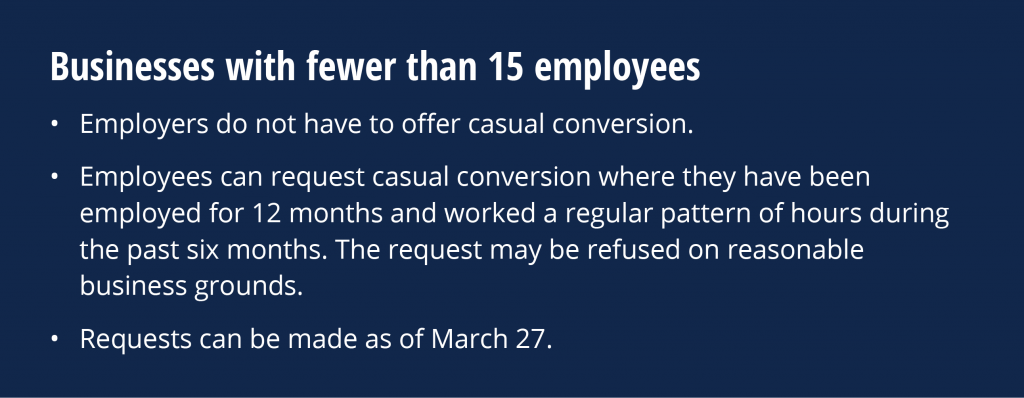

Different rules apply to small businesses.

Martin explains that this National Employment Standards provision also requires employers to provide casual workers a casual employment information sheet that outlines the conditions around converting to permanent status.

While the changes came into effect on March 27, there are transitional arrangements in place to give employers time to become familiar with the changes.

What about apprentices and trainees?

CCIWA’s ASA Administration Manager Louisa Lidington says when employers are looking to convert their casual staff to permanent workers, they may engage them as apprentices or trainees.

She explains that apprentices and trainees can't be casual, but must be either full-time or part-time.

As a result, bringing a training element into the conversion process has benefits for some employers.

“Apprenticeships and traineeships can be anywhere from 15 hours per week as the minimum requirement to 20 hours as the minimum – full time is anything as per the award but normally 38 hours,” she says.

Lidington adds that these training mechanisms can be a great way to upskill and retain your staff, and plug impending skills gaps across many industries.

Another benefit of apprenticeships and traineeships is the government incentives to subsidise employers for investing in skills.

Who is eligible for a subsidy?

Whether your apprentice or trainee can be eligible for a subsidy comes down to their status as a new or existing employee and whether they have had any recent similar training.

As Lidington explains, if your worker is already qualified in the same occupation in which you're offering training, this disqualifies them from an incentive.

New workers are more likely to qualify for subsidies than existing workers, and a worker is considered new if they have been with the company for less than three months full time or less than 12 months part time or casual.

If the employee is an existing worker, you are more likely to receive incentives for apprentices or trainees in occupations deemed a priority, such as those in trades and aged care or disability services.

Contact ASA for more details about how you can include apprentices or trainees into your business, on 1300 363 831 or [email protected].